Energy storage in 2021: a “very hot” topic, which brought results and discussions throughout the year. Now that the year is ending, let’s see what the challenges and opportunities of this macro-theme are, in the study proposed by IDTechEx.

Energy storage in 2021: challenges and opportunities

Energy storage technologies are undergoing a challenging, vital transformation in an emerging climate that increasingly requires renewable energy and recyclable hardware. Energy storage sectors, such as Li-ion batteries, are expected to grow rapidly, while supply chain constraints mean that new alternative energy storage technologies are being developed, creating new opportunities. Covering a broad portfolio of energy storage technologies, their history and their prospects for the future, IDTechEx examines how the energy storage industry has performed over the past year and where it is headed for the next.

Li-ion and demand for materials

Demand for Li-ion batteries is expected to grow rapidly over the next 10 years, driven primarily by the electrification of transportation. This will result in increased demand for battery electric cars, but also for a broad spectrum of vehicle types and segments, and it is these non-automotive segments that many package manufacturers will target. IDTechEx’s report “Lithium-Ion Batteries for Electric Vehicles 2021-2031” covers trends in battery technology for electric vehicles and studies package manufacturers targeting buses, commercial vehicles and many other non-automotive segments. However, while Li-ion will continue to remain the dominant technology in electric vehicles, fears of potential bottlenecks in the supply of some critical materials, such as lithium, nickel or graphite, may ultimately limit the adoption rate of EV. IDTechEx’s report “Electric Vehicle Battery and Battery Pack Materials 2021-2031” predicts growth in demand for Li-ion battery materials included in the cell and pack, while IDTechEx also covers the broader Li-ion market, including detailed analysis of technology and players. In addition to the problems that can be caused by the rapidly growing demand for materials, there are also concerns about the environmental impact and sustainability of Li-ion production.

Recycling of lithium ions

Recycling offers a partial solution to the sustainability and supply chain problems faced by the lithium ion industry by providing some degree of circularity – materials from waste and end-of-life batteries can be extracted and refined for reuse in the production of cells and batteries. This can have several positive impacts. It can diversify supplies of materials, helping to reduce dependence on a single country or region. From an environmental perspective, recycling of lithium ions, especially through hydrometallurgical or direct recycling routes, should reduce the total energy requirements of producing a cell, compared to using virgin materials. Other emissions, including SOx, NOx and particulate matter, in addition to CO2, are also expected to be lower using recycled material than from primary extraction. Local recycling and refining capacities, as they are starting to be built in Europe and the United States, can also reduce the distance traveled by materials by further reducing the emissions profile of Li-ion batteries. However, even if enough recycling capacity were built to handle the full volume of Li-ion battery waste by 2030, the recycled material could only contribute to a fraction of the material demand.

To help alleviate possible supply chain constraints, a number of alternative battery and energy storage technologies are being developed that may be able to replace Li-ion batteries in applications where energy density is not. such a critical parameter. Applications for these technologies could include small electric city cars, e-buses, hybrid electric vehicles, fuel cell trucks, or self-driving vehicles, all covered by IDTechEx’s EV research portfolio. But the range of available and developing energy storage technologies is most evident in the stationary energy storage sector. This is true because energy density becomes a less critical factor in stationary energy storage, allowing the use of a range of technologies.

To find out more about the stationary storage and electric vehicle markets, please consult the reports “Batteries for stationary energy storage 2021-2031” and “Electric vehicles: Land, sea and air 2021-2041”. A more detailed analysis of the individual EV segments can be found in the specific reports on electric buses, cars, 2-wheelers, commercial vehicles and boats, among others.

Solid state batteries

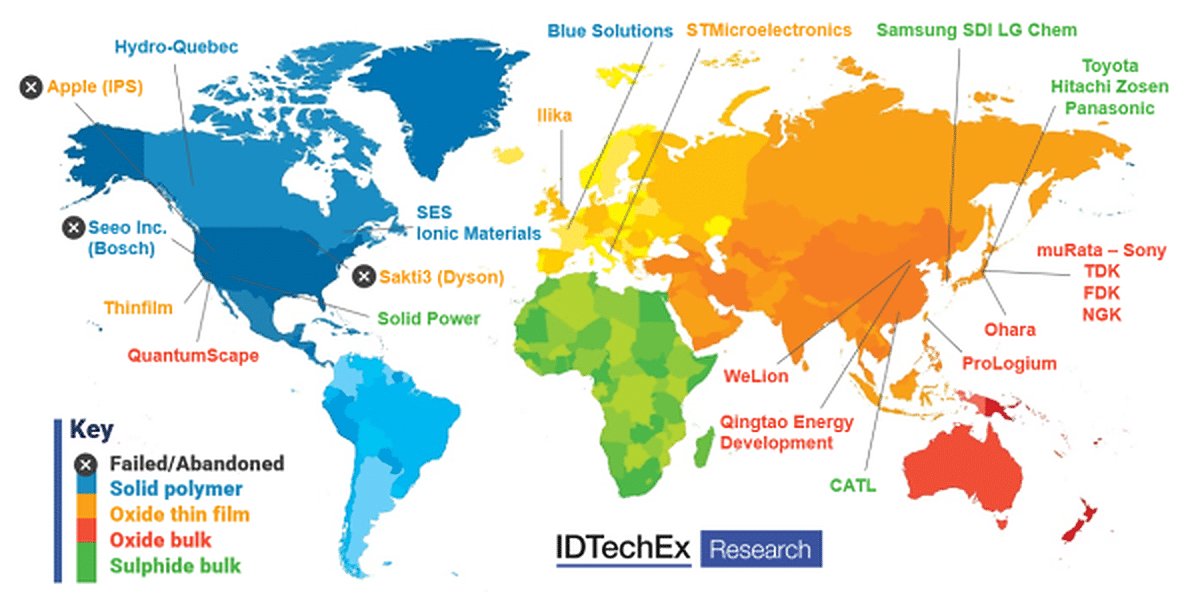

With Solid Power and QuantumScape going public, solid state batteries are attracting tremendous attention, especially for electric vehicle applications. Electric vehicles are the primary motivation for solid-state battery development, and many automotive OEMs have announcements for the coming year. There have been improvements in every section of solid-state battery technology: polymer, oxide and sulfide. Of these improvements, one notable is that a lithium metal anode is essential for achieving higher energy density, increasing the performance of solid-state batteries to make them more competitive. Moving from material / cell development to pilot and mass production is also an important trend. It is quite common to find solid state battery players partnering with automotive OEMs for further development. Details on the technologies, players and markets can be found in the research on solid-state and polymer batteries.

Thin, flexible and printed batteries

Thin, flexible and molded batteries have been around for a while, and many of them have found niche applications. Many of the batteries have mature technology, but finding suitable applications with great demand is the key to growing this technology. There are quite a few companies on the market working in this industry, which means that the competition is constantly growing. The company that identifies the most relevant applications – those that require the special features of flexible and thin molded batteries – will be the one that will succeed and corner this market. For more details please see the IDTechEx report on Thin Film, Flexible and Printed Batteries.

Na-ion

Na-ion has seen renewed interest following CATL’s announcement of their Na-ion development. Similar in many ways to Li-ion batteries, Na-ion batteries use Na as the working element instead of Li, as the name would suggest. Na-ion batteries are generally characterized by having slightly higher power and cycle lives than NMC and LFP Li-ion cells, but with slightly lower gravimetric energy density. While Na-ions will obviously reduce dependence on lithium, their cathodes can still make use of cobalt and nickel, and so whether they can be used to reduce dependence on these materials depends entirely on the chemical specifications of the cathodes that will be used.

To learn more about the technological capabilities of the different battery forms, see Advanced Lithium-Ion Batteries.

Redox flow batteries

Redox flow batteries differ from intercalation batteries such as Li-ion and Na-ion, by storing the energy in the electrolyte, separated from the electrochemical cell, thus allowing the decoupling of the energy power. This key aspect makes RFBs very suitable for stationary storage applications, especially those of long duration. Vanadium is by far the most popular chemistry, with 15-20 companies marketing vanadium systems. However, the high cost of vanadium leads to high capital costs that can be prohibitive for widespread use, even as schemes such as electrolyte leasing are being explored to try to reduce the initial capital outlay. However, the high cost of vanadium has led to the development of alternative RFB chemicals that use low-cost active materials, such as the entirely iron-based chemistry developed by ESS Inc or even flux batteries that can use low-cost organic compounds. and widely available as an active electrolyte material.

Alternatives and hydrogen

Non-electrochemical technologies such as gravitational storage or cryogenic air storage are also being explored, but they are in an early stage of development and may not be suitable for cost-effective storage over longer periods. Balancing supply and demand for grids using high percentages of variable renewable energy will require a combination of energy storage, overcapacity, interconnection and other solutions such as vehicle-to-grid capacity and demand-side response. Indeed, a variety of non-electrochemical storage technologies, from supercapacitors to compressed air energy storage, have been explored for stationary applications.

Green hydrogen is also being discussed as a potential solution for long-term energy storage and continues to receive government support. Electrolysers, whether they are PEM, alkaline or solid oxide types, can be used to produce hydrogen from water to be stored for use at a later time. It remains to be seen whether long-term storage of hydrogen will become feasible. Storage in gas cylinders may be too expensive, while underground storage in aquifers or salt caves, for example, has geographic constraints and remains relatively untested. An alternative method of H2 storage that is being explored is to inject H2 into existing natural gas pipelines, where there is a capacity …

Leave a Reply

View Comments