On the occasion of the launch of cryptocurrency trading in Italy by Trade Republic, the largest savings platform in Europe, we had the opportunity to interview Emanuele Agueci, Country Manager for Italy of the company. Trade Republic arrived in Italy a month ago, and with these new features it confirms its ambitious projects for our country, which we have deepened with Emanuele Agueci.

What is Trade Republic?

Trade Republic is an investment and savings platform, created in Berlin in 2015. After 4 years of research and development, it was launched in 2019, getting quite impressive feedback: after less than 24 months, we have more than a million active customers and more than 6 billion in assets under management. At the moment, Trade Republic is the number 1 investment and trading app in Germany for monthly active users. There was a market need that was fully met and satisfied.

Trade Republic was the subject of one of the continent’s largest funding rounds this summer, and raised nearly € 900 million, mainly used to finance international expansion. At the moment it is present in 6 countries, in Italy since December 16. There is a lot of expectation for Italy, which was immediately indicated as one of the countries with the highest potential.

On Trade Republic it is possible to buy 9000 shares and ETFs and over 4500 of these can be purchased through a savings plan. Our strengths are the top-of-the-class interface and user experience and our commission structure. For all our transactions, regardless of their size, you always pay only 1 euro. There is no percentage commission whatsoever. Another flagship of ours are the savings plans, which are completely free. A customer can invest the amount they prefer, every 15 days, a month or two months, and the transactions are completely free.

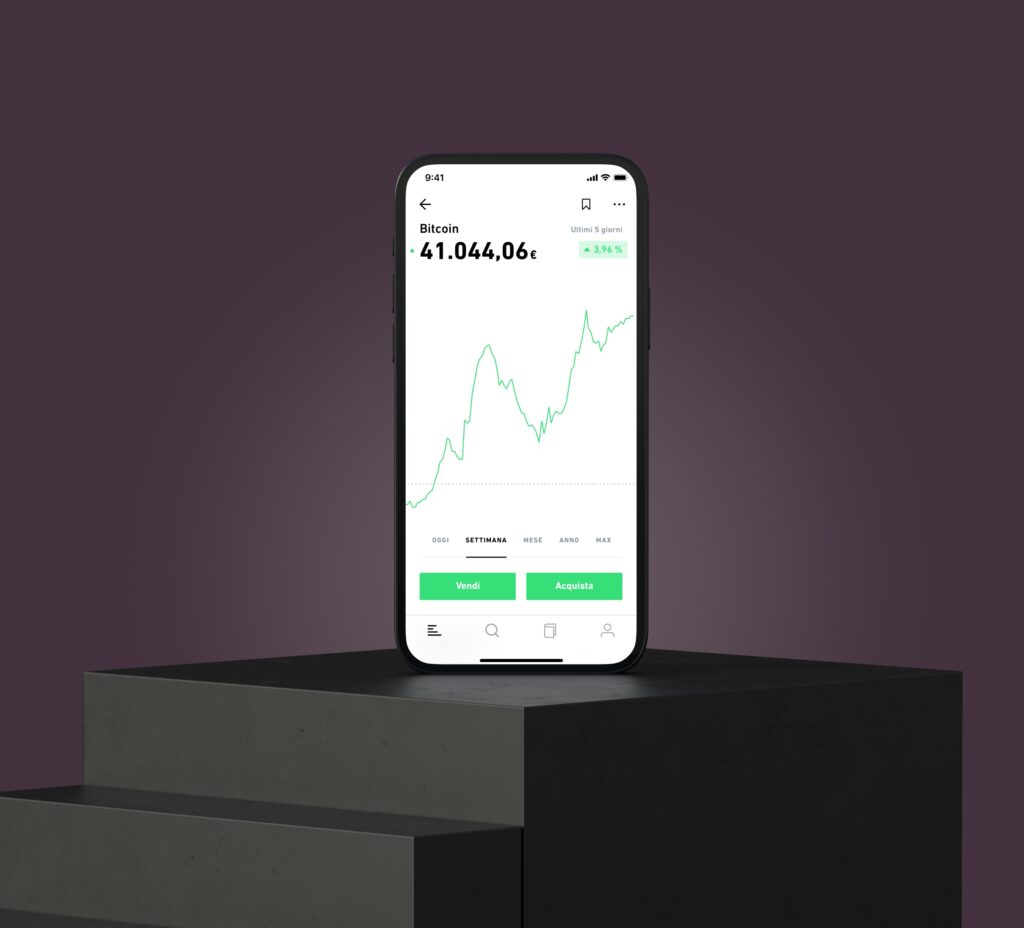

Since yesterday we have also launched trading on 9 of the main cryptocurrencies by market capitalization and low volatility. The commission structure on cryptocurrencies is identical to the rest: you always pay only 1 euro. Certainly an attractive offer, especially when compared to that of other players of this service. In fact, with a percentage commission structure, you can get to pay a commission of 50-60 euros without even realizing it. At the moment, Trade Republic is the only investment suite that allows you to have access to such a large number of products with such low commissions.

How did the first month of Trade Republic go in Italy?

It’s going very well, but we weren’t surprised. Expectations were high, we had already had a great response when we launched the waiting list in October last year. Now that we are finally available, the numbers are proving us right: there is a lot of interest and a lot of activity. However, we know that there is still a lot to do. Italy is a particular country in the context of the continent. There are many savings on current accounts, but there is still no investment culture. A slice of the population still does not realize how much potential additional wealth it is not unlocking because it does not think about investing, which seems too complicated or something that only a business graduate can do. Instead it is not like that. Today there are both technological tools and financial products, and even those without skills can enter this world.

In this regard, what strategy do you want to adopt to overcome the prejudice that still exists on cryptocurrencies?

Our mission is to break down every barrier to investment, and make investments available to anyone who is of age and has even just a few savings available. The addition of cryptocurrencies within Trade Republic ties in perfectly with this goal. In fact, breaking down all barriers means making all asset classes accessible to a large public. This does not mean that you shouldn’t research first or that you don’t need to invest responsibly and sustainably, but it is also important to have the widest choice possible, and we continue to develop our platform in this direction.

Financial education is very important. We are not a university, but we strongly believe that the more people invest, the more financial wealth will be generated and the more financial security will come for those who invest and their loved ones. This is what motivates us every day.

What is your current offering for classic stock trading?

We currently manage around 7,500 stocks and 1,500 ETFs. Some of these ETFs are particularly accessible for those inexperienced. More than 50% of those who buy ETFs on Trade Republic buy MSCI World, the most stable and diversified ETF ever. We have an audience of small savers who want to beat inflation and put their money to work. For the Italian public, it may be interesting to know that we currently fully hedge the FTSE MIB, so all blue chip stocks are hedged. We don’t have full coverage of Piazza Affari yet, but we are getting closer. We also aim to observe what our customers ask for, to bring it to our platform. There have been many new quotes in the past few months, and we are working to make them available to our customers quickly.

What is Trade Republic’s offering for cryptocurrencies?

Cryptocurrencies can be purchased in a fractional manner, always with the commission of 1 euro per transaction. There is a minimum amount for the purchase of cryptocurrencies, but very affordable for anyone. The 9 cryptocurrencies we manage have been selected by market cap, the most important are certainly Bitcoin, Ethereum, Litecoin, Uniswap and Chainlink. The idea is to continually expand the selection of assets on offer. There will always be a careful selection of all the crypto projects that we will bring on board, we always expect a certain solidity.

For cryptocurrencies, we rely on an external custodian as an additional level of guarantee. Furthermore, cryptocurrencies are stored offline in a cold wallet. They are real cryptocurrencies, owned by our clients. We have a banking license in Germany and are authorized by CONSOB to operate in Italy, as a further guarantee for our customers, both on deposits and on assets.

Are you planning to add cryptocurrency investment tools such as copy trading?

Copy trading is not on our road map, because we want to actively discourage all the playful aspect of investments, instead ridden by some of our competitors. We believe it is dangerous behavior, which can hurt those who sweat their money. Precisely for this reason we have encouraged the savings plan, which allows customers to invest responsibly. Gamification and social trading are concepts that do not belong to us. We do not exclude activating savings plans also on crypto, which go well with our mission. In fact, if we look at cryptocurrencies as a diversification tool in our portfolio, there is no reason not to invest a small amount each month in Bitcoin. At the moment, however, this functionality is not provided.

Are you planning to add support for the purchase of NFT or Fan Token?

Not at the moment. Not until we are sure we can offer the right guarantees to our customers.

What tools does the Trade Republic app offer to potential cryptocurrency investors?

Within the detail page of each instrument, including cryptocurrencies, we offer a summary of the project. For stocks, we also offer an external analyst rating. There are the historical trend of the stock price and several performance indicators. For crypto, we also offer a link to the project website, in case anyone wants to go deeper. However, we aim to enhance the training offer more and more. In Germany there is a Trade Republic podcast, which is the number 1 podcast in the financial environment. There is a blog, where information material is regularly published and a very well-stocked help center. These services are particularly appreciated by the public, which we will continue to expand in Italy as well.

How do you think cryptocurrencies will evolve in the coming years?

Crypto as an asset class already has a high circulation rate. According to some studies, 18% of Italians own Bitcoin, and probably in other countries the figure is even higher. It is becoming a popular investment category, and more and more institutional investors are starting to expose themselves to crypto, which will help reduce volatility. These two aspects combined in my opinion lead us to a point where we can no longer speak of a bubble, then obviously no one has the crystal ball to predict the future. Surely, diffusion is becoming widespread and can become a stable component in an investment portfolio. As for use in everyday life, it is still a bit early, although there are many projects in this regard. Certainly, as long as the euro prices of cryptocurrencies are high, it is difficult to think of their practical application.

What advice do you give to first-time cryptocurrency investors?

Always and only invest what you are willing to lose, and invest only a small part of your portfolio, trying to diversify as much as possible. Don’t look at the single cryptocurrency but at a basket of cryptocurrencies, with not too specific exposure. Finally, I always recommend thinking about long-term investments: according to statistics, 9 out of 10 cheats end up losing their money. Never believe you can be smarter than anyone, buying in the morning and selling in the evening. Only very few make it, this is not the right perspective. It is necessary to save, invest and keep the investment, because statistically, over a long time horizon it is difficult for a well-diversified portfolio to lose value.

The two biggest resistances on cryptocurrencies are certainly the possibility that they are a bubble on the verge of bursting (as you also remembered) and the mistrust of the potential for a high profit like the one had by Bitcoin and Ethereum in recent years. How do you respond to this last observation?

The doubt about the possibility of earnings there were those who also had it 3, 4, 8 years ago, but …

Leave a Reply

View Comments