Hype is the first Italian fintech for money management through apps and a joint venture between the Sella group and Illimity. He nominated a new CEO which corresponds to the name of Joseph Virgone and entrusted him with leading the next phase of development.

Giuseppe Virgone, the new CEO of Hype

After leading the development of PagoPa SpA., leading the company to position itself as one of the key realities for Italian digitization, Giuseppe Virgone is appointed CEO of Hype. His goal for this new experience is to shorten the distances between consumers and money control and management tools. This facilitates financial inclusion also in the digital world.

Giuseppe Virgone, who is he?

Virgone, born in 1968, began his career in thetechnology and banking, dealing with ICT in the banking sector from different positions. In 2006 he founded due startup which achieve important awards. Instead, in 2016, she starts working for PagoPa and then becomes one Sole Director.

To him, who has already shown that he knows how to successfully achieve different and challenging objectives, the shareholders entrust the important phase of growth and consolidation of HYPE. A challenge that the Italian fintech, with its team of over 100 technology, finance and banking experts, is ready to take on the strength of a growth that has already seen it chosen by 200,000 new users in the last year alone, bringing total customers to over 1.7 million.

Hype, what is it

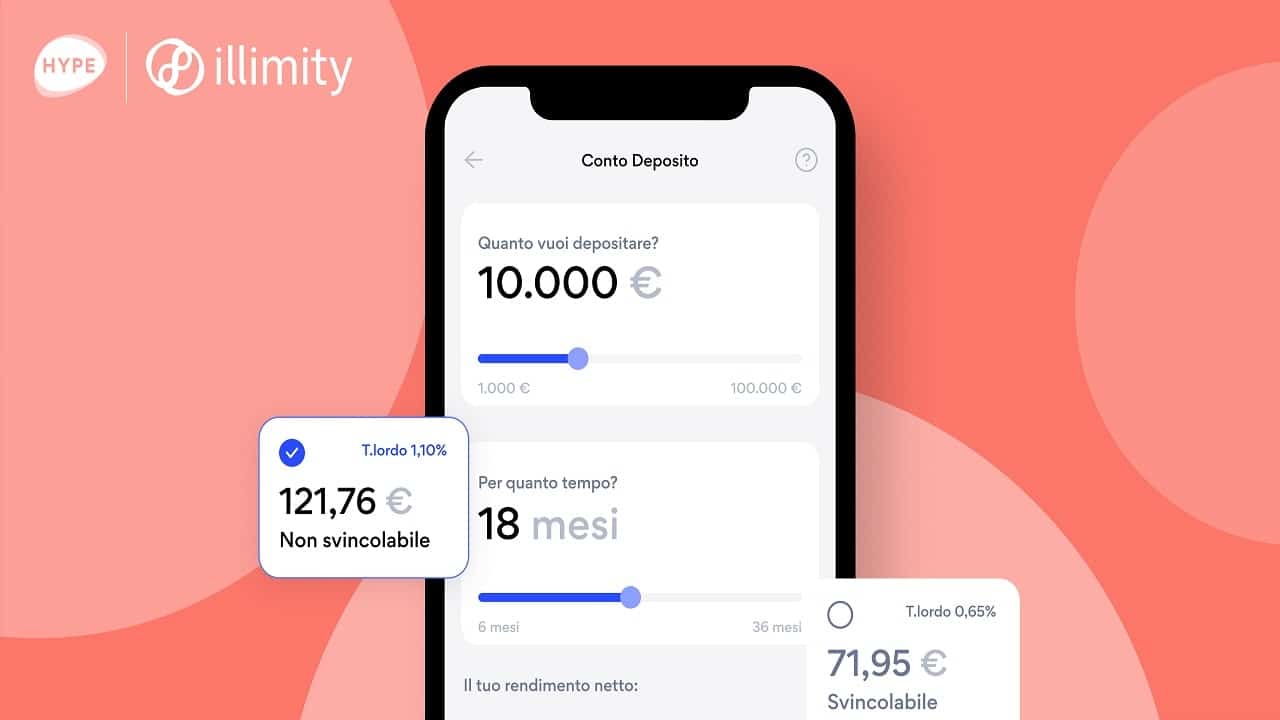

HYPE, authorized to operate as an electronic money institution and AISP and PISP, is the control room for personalized, simple and efficient money management. It works through an account, which can be activated directly from a smartphone, in a few minutes and in total security, a Mastercard card that arrives at home and a mobile app from which to access all the main financial and other value-added services.

Born as a simplified alternative to traditional models, HYPE has established itself as the first Italian fintech, a point of reference in money management via apps thanks to the ability to rethinking and reinterpreting the world of banking in the light of the opportunities opened up by regulatory evolution and the ability, as a tech company, to read and anticipate customer needs.

Own services such as wire transfers and payments, and offered by partners, such as loans, savings and investments, with access thresholds starting from a few euros, join other innovative and constantly evolving ones that make reality a point of reference for being aware of the own resources and financial capabilities.

Leave a Reply

View Comments