The AMD company today released its record-breaking financial results for the second quarter of 2022

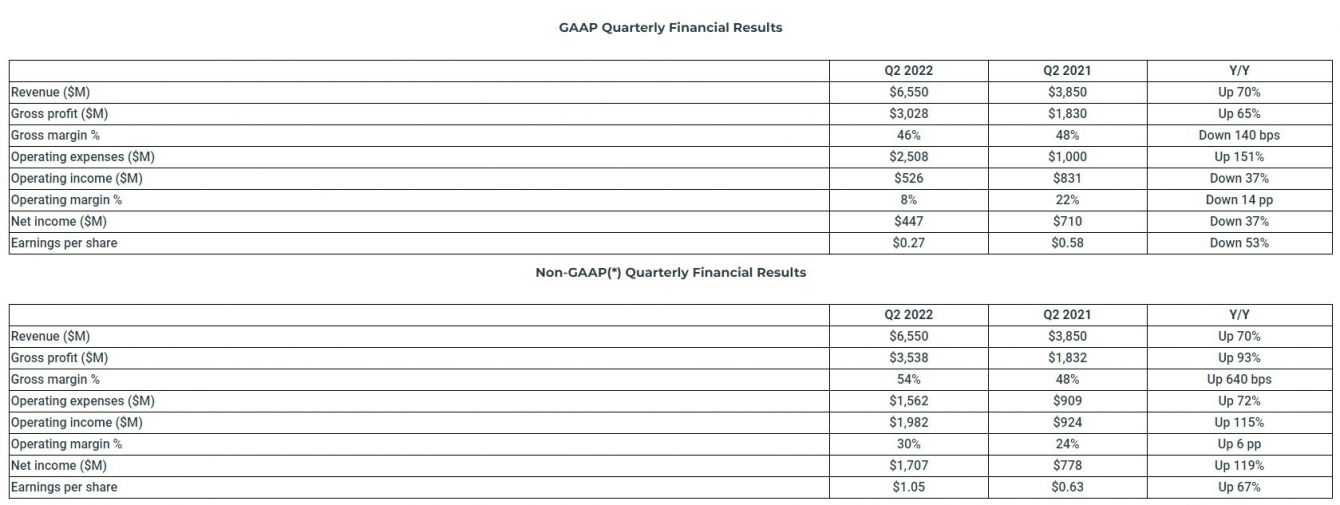

AMD (here for more about the company) today announced second quarter 2022 revenue of 6.6 billion dollarsgross margin of 46%. Operating profit of $ 526 million, operating margin of 8%, net income of $ 447 million and diluted earnings per share of $ 0.27. On a non-GAAP basis, gross margin was 54%, operating income was $ 2.0 billion, operating margin was 30%, net income was $ 1.7 billion, and diluted per share was 1.05.

Statements regarding AMD’s record 2022 financial results

We achieved our eighth consecutive quarter of record revenue based on our solid execution and product portfolio expansion,

he has declared Lisa Su, president and CEO of AMD. Which then went on to state:

Each of our segments grew significantly year-over-year, driven by increased sales of our data center and embedded products. We see continued growth in the second half of the year highlighted by our next generation 5nm product shipments and supported by our business model diversification.

Financial summary for the second quarter of 2022

The revenues of $ 6.6 billion was up 70% year-over-year driven by growth in all segments and the inclusion of Xilinx revenues. They had a gross margin was 46%, a decrease of 2 percentage points on an annual basis. Mainly due to the amortization of intangible assets associated with the acquisition of Xilinx. While the gross margin does not GAAP was 54%, with an increase of 6 percentage points on an annual basis. The latter was mainly due to higher revenues in the Data Center and Embedded segment. Operating income was 526 million dollars, or 8% of revenues, compared to $ 831 million or 22% a year ago. This is mainly due to the amortization of the intangible assets associated with the acquisition of Xilinx. Record non-GAAP operating income was $ 2.0 billion, or 30 percent of revenue, up from $ 924 million or 24 percent a year ago. This is mainly due to higher revenue and gross profit.

AMD record results 2022 also for the profit

L’net profit was 447 million $ 710 million a year ago mainly due to lower operating income. A net profit non-GAAP record was $ 1.7 billion, up from $ 778 million a year ago. Mainly due to the increase in operating income. Diluted earnings per share were 0.27 compared to 0.58 a year ago, mainly due to lower net income. Non-GAAP diluted earnings per share was 1.05 compared to 0.63 a year ago, mainly due to the increase in net income. Cash, cash equivalents and short-term investments were $ 6.0 billion at the end of the quarter and debt was $ 2.8 billion. AMD has repurchased 920 million common stock during the quarter.

Financial summary of the quarterly segment

AMD previously announced new segments starting in the second quarter to align financial reporting with how AMD now manages its business in strategic end markets.

- The segment Data Center include CPU per server, GPU per data centerproducts for data centers Thinking and Xilinx.

- Instead, the client segment includes processors and chipsets for PC desktop e notebook.

- The gaming segment includes graphics processors discrete and semi-custom game console products.

- While the embedded segment includes products embedded AMD e Xilinx.

The results of the previous period were brought into line with the new reporting segments for comparative purposes. The turnover of the Data Center segment was 1.5 billion dollars, up 83% year-over-year thanks to strong sales of EPYC server processors. Operating income of 472 million dollars, or 32% of revenue, up from $ 204 million or 25% a year ago. The improvement in operating income was mainly determined by higher revenues, partially offset by higher operating costs.

AMD record 2022 results for the customer segment

The turnover of the customer segment was 2.2 billion dollarsin growth of 25% year on year thanks to the sales of mobile processors Ryzen. Client processor ASP has increased year over year thanks to a richer mix of Ryzen mobile processor sales. Operating income was $ 676 million, or 32 percent of revenue, compared to $ 538 million or 31 percent a year ago. This improvement in operating income was mainly driven by higher revenues, partially offset by higher operating costs.

Gaming segment

The turnover of the gaming segment was 1.7 billion dollarsin growth of 32% year on year thanks to the increase in sales of semi-custom products, partially offset by a decline in revenue from game graphics. Operating income of 187 million dollars, or 11% of revenue, up from $ 175 million or 14% a year ago. This improvement in operating income was mainly driven by higher revenues, partially offset by higher operating costs. Operating margin was lower mainly due to lower graphics revenue and higher operating expenses.

Results for the embedded segment

The revenues of the embedded segment were 1.3 billion dollarsin growth of 2.228% year on year thanks to the inclusion of Xilinx embedded revenues. Operating profit was $ 641 million, or 51 percent of revenue, compared to $ 6 million or 11 percent a year ago. Operating profit and margin improvement were mainly driven by the inclusion of Xilinx revenues.

All other operating losses were $ 1.5 billion compared to 92 million a year ago due to the amortization of intangible assets largely associated with the Xilinx acquisition.

Recent major PR

At his Financial Analyst DayAMD detailed leadership roadmaps and a extended product portfolio. This is to offer its next phase of growth in the market estimated at $ 300 billion for adaptive computing solutions and high performance. Among these we have:

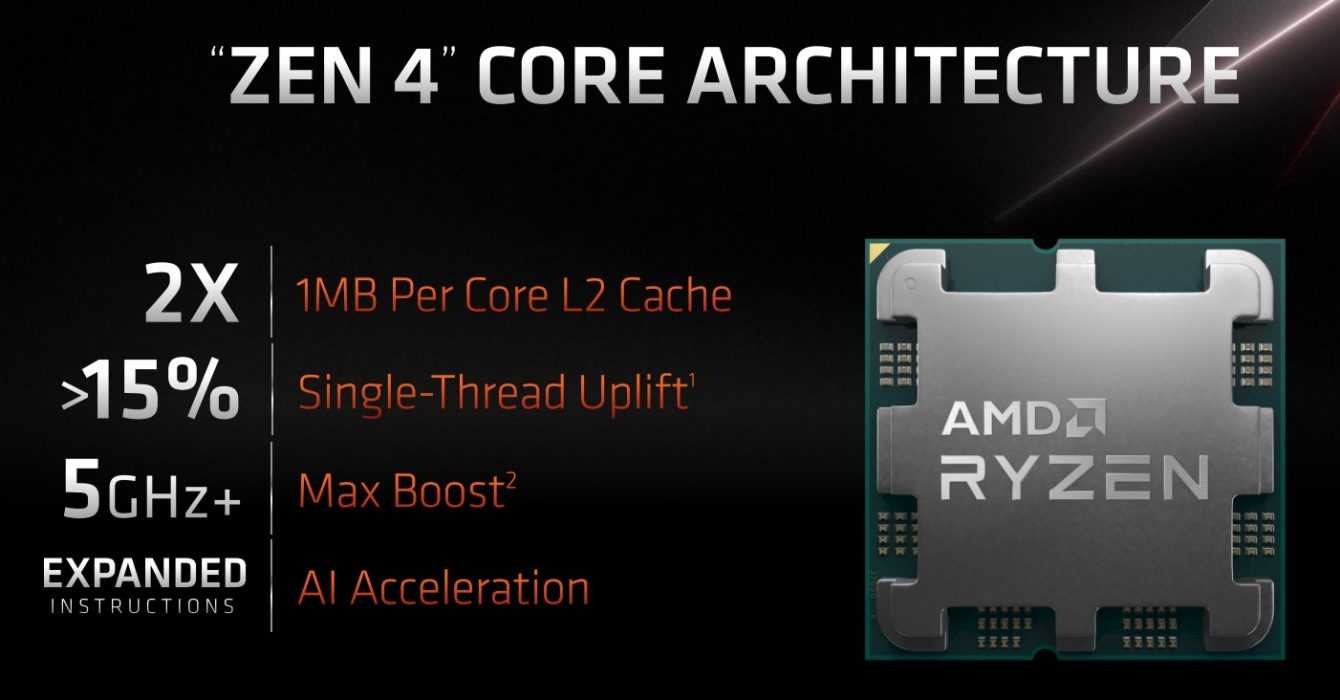

- New details on the “Zen 4” core architecture, which should provide significant performance and energy efficiency improvements over the previous generation.

- The core “Zen 5”Scheduled for 2024, built from the ground up to extend performance and efficiency leadership across a wide range of workloads.

- Graphic architecture AMD CDNA 3 with 3D stacking, fourth generation Infinity architecture. Next generation AMD Infinity Cache technology and HBM memory in one package. To power what should be the world’s first data center APUs, AMD Instinct MI300 accelerators.

- L’AMD RDNA next generation graphics architecture 3 it should deliver over 50% more performance per watt than the previous generation.

- Technology AMD XDNA, Xilinx’s core IP architecture consisting of key technologies including FPGA fabric and AI Engine (AIE). Which should be integrated into the AMD product range starting with the “Zen 4” architecture based on “Phoenix Point” “mobile processors expected for 2023.

- And expanded portfolio of data center CPUswhich includes the first processor AMD EPYC optimized for intelligent edge and communications deployments. Code name “Siena”. And the “Bergamo” processors, which are expected to be the highest performing server processors for cloud native computing at their expected launch in the first half of 2023.

The acquisitions

AMD completed theacquisition of Pensando Systems in a transaction worth approximately $ 1.9 billion to expand AMD’s data center product portfolio. Pensando DPUs are already widely deployed across cloud and enterprise customers, including Goldman Sachs, IBM Cloud, Microsoft Azure, and Oracle Cloud. The supercomputer Frontier, powered by AMD EPYC CPUs and AMD Instinct accelerators, achieved a crazy result. THEl first place in the latest performance rankings TOP500, GREEN500 and HPL-AI. And it was the first supercomputer to break through the exaflop barrier. The HPC industry continues to show a rapidly growing preference for AMD solutions, with a 95% year-over-year increase in the number of AMD-based systems in the TOP500 list. While the cloud computing industry continues to show a growing preference for AMD products. Google Cloud N2D and C2D virtual machines (VMs) enable advanced security offerings with 3rd generation AMD EPYC processors

New Ryzen 7000 series processors

At COMPUTEX 2022, AMD provided new details on new Ryzen 7000 series desktop processors, based on the 5nm “Zen 4” architecture, which is expected to launch in the fall. The platform AMD Socket AM5, which provides advanced connectivity for the most demanding enthusiasts and gamers. AMD also announced the graphics cards Radeon RX 6950 XT, RX 6750 XT e RX 6650 XT, featuring faster game clocks. In addition, they have faster GDDR6 memory and improved software and firmware compared to previous generation products.

AMD’s current outlook after record 2022 results

AMD’s forward-looking statements are based on current expectations. The following statements are forward-looking and actual results could differ materially depending on market conditions and the factors disclosed in the “Disclosure Statement”. For the third quarter of 2022, AMD expects sales of approximately $ 6.7 billion. Plus or minus $ 200 million, an approximately 55% year-over-year increase driven by growth in the Data Center and Embedded segments. AMD expects non-GAAP gross margin to be approximately 54% in the third quarter of 2022. For the full year 2022, AMD continues to expect a turnover of approximately 26.3 billion, more or less 300 million. An increase of about 60% compared to 2021 driven by the growth of the Data Center.

And you? What do you think of these new results financial records achieved by AMD and its great growth year by year? Let us know with a comment and stay tuned to TechGameWorld.com for more news and reviews from the world of technology (and more!).

The AMD article: Record Financial Results for Q2 2022 comes from TechGameWorld.com.

Leave a Reply

View Comments