When you want to do Immediate Edge trading, i.e. make money with very short-term trading, it is very important to know the theory. That is why we tell you about the best technical indicators for Immediate Edge

Immediate Edge is a term widely used in the world of financial trading. Represents the ability to make quick and effective decisions based on precise and accurate analyses. Technical indicators are an essential tool for traders looking to gain a short-term edge in the financial markets. In this article, we will explore the best technical indicators that can help you reach an immediate edge in your trading activities.

What is a technical indicator for Immediate Edge?

A technical indicator is a tool used in technical analysis to provide trading guidance based on past data the prices of a financial asset. These indicators can be used to identify trends, reversal points, overbought or oversold conditions, and other information that can help traders make informed decisions.

Trend indicators for Immediate Edge

Media Mobile

The moving average is one of the best indicators for identify and confirm market trends. There are several types of moving averages, including simple moving average (SMA) and exponential moving average (EMA). The SMA calculates the arithmetic mean of the closing prices over a given period of time, while the EMA gives more weight to the most recent data. The intersection of a moving average with prices can provide buy or sell signals.

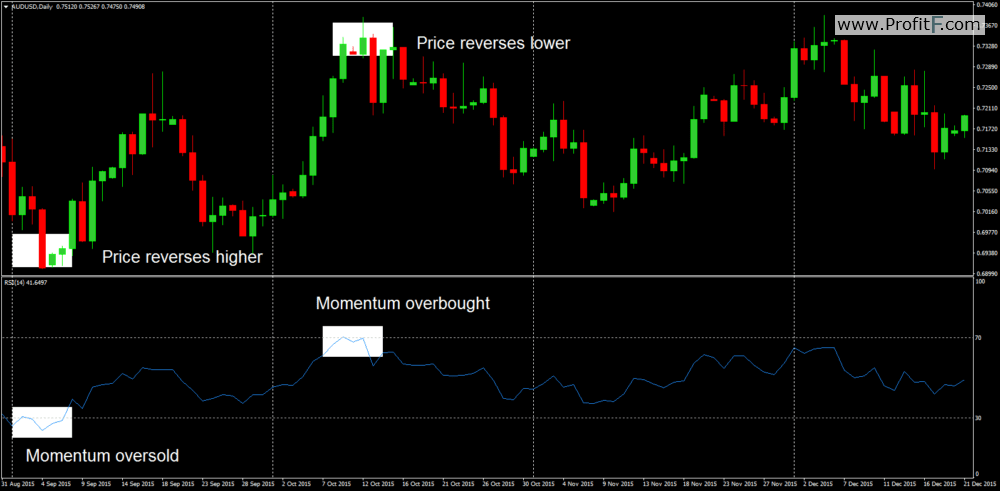

Relative Strength Index (RSI)

The RSI is a widely used momentum indicator that compare the strength of the upswings versus the downswings and gives an indication of the asset it might be overbought or oversold. The RSI ranges from 0 to 100 and values above 70 usually indicate an overbought asset, while values below 30 indicate an oversold asset.

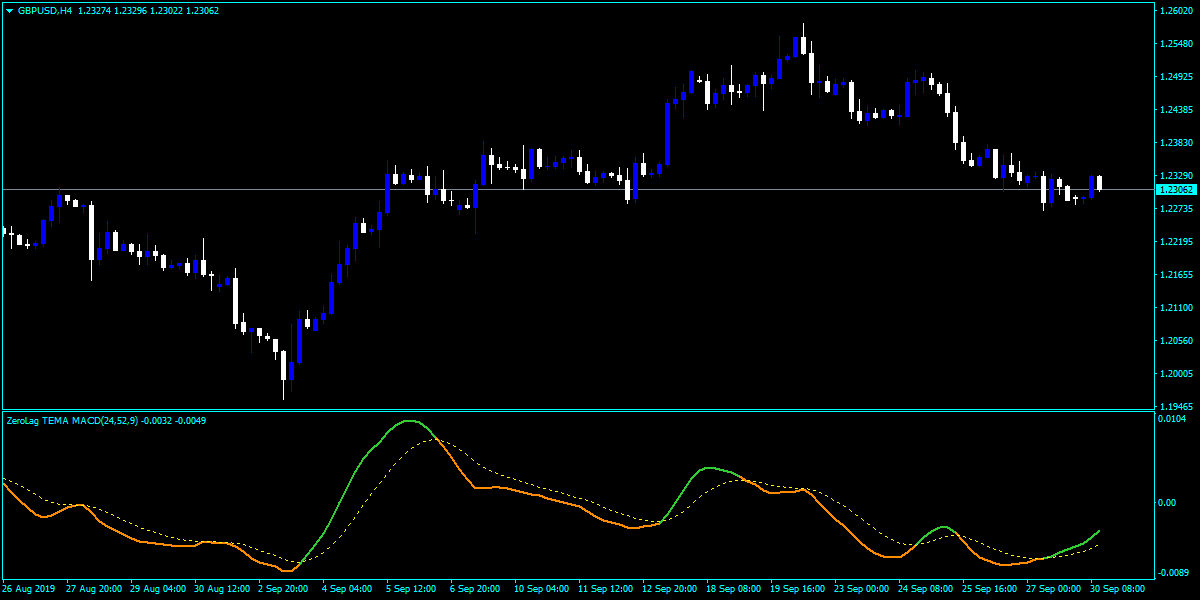

MACD (Moving Average Convergence Divergence)

The MACD is a trend indicator that shows the relationship between two moving averages of different lengths. It consists of a main MACD line and a signal line, which represents the moving average of the main MACD line. The intersection of these two lines can provide buy or sell signals.

Swing Indicators for Immediate Edge

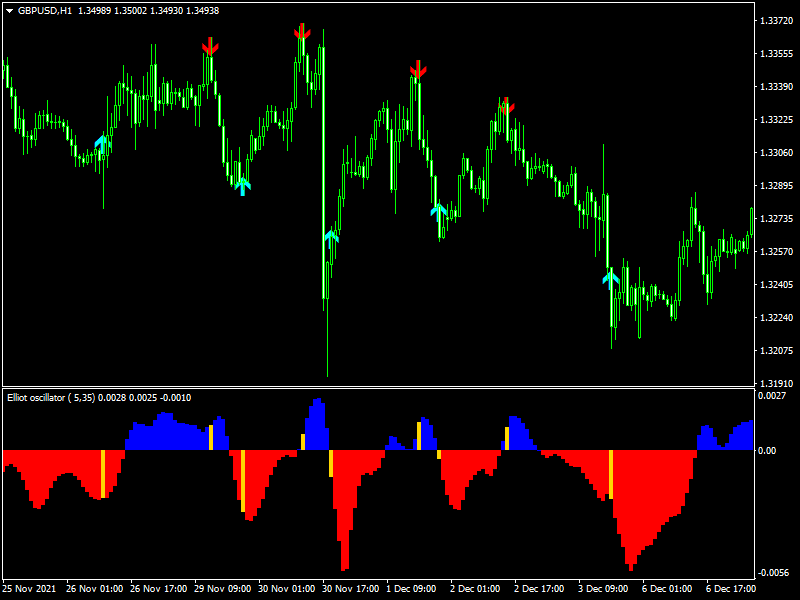

Stochastic Oscillator

The Stochastic Oscillator is a momentum indicator used for identify potential tipping points. Measures the position of the closing price relative to the price range over a given period of time. The Stochastic Oscillator fluctuates between 0 and 100 and values above 80 usually indicate an overbought asset, while values below 20 indicate an oversold asset.

Bollinger Bands

Bollinger Bands are an indicator of volatility which draws two lines above and below a moving average. The bands expand and contract based on the volatility of the asset. When the bands widen, it indicates an increase in volatility, while when they contract, it indicates a decrease in volatility. Points where prices touch or approach the bands can provide trend reversal signals.

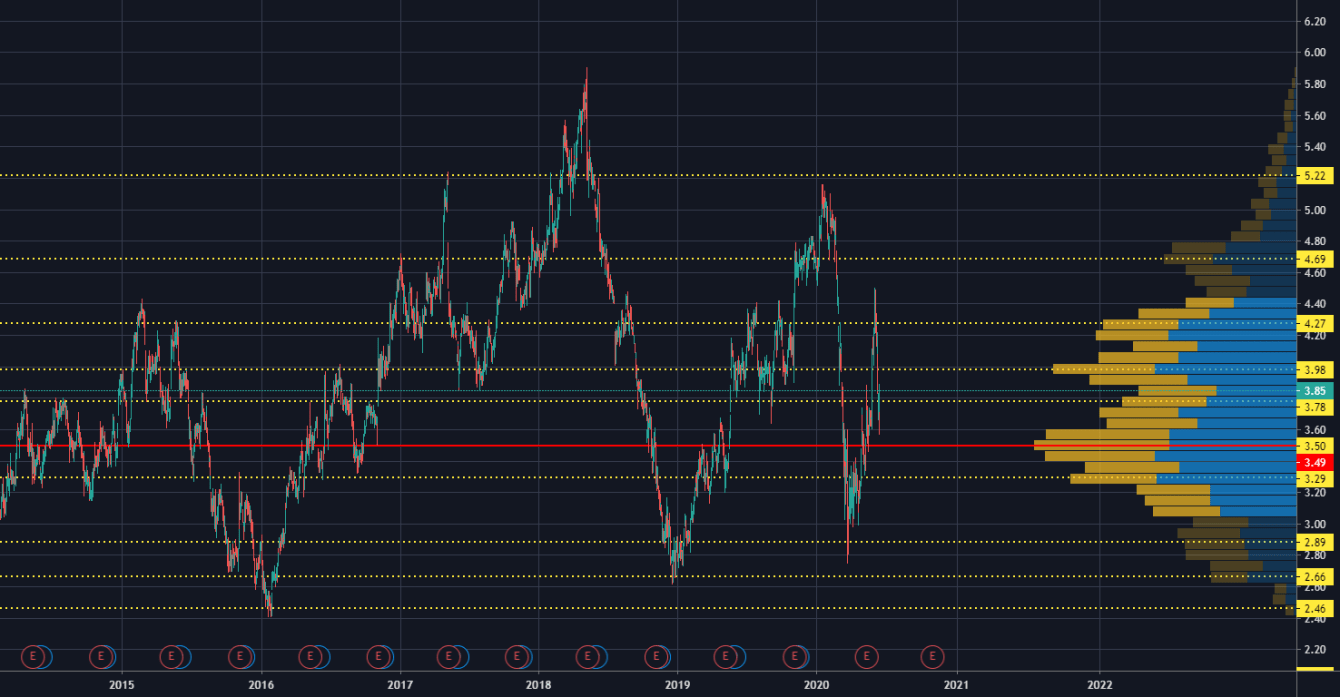

Volume indicators for Immediate Edge

Volume indicator

The volume indicator is used for evaluate the buying or selling pressure of an asset. An increase in volume often indicates increased interest from traders, while a decrease in volume can indicate a lack of participation. Volume analysis can help confirm price movements and provide clues about the strength of a trend.

Accumulation/Distribution line

The accumulation/distribution line is a volume-based indicator that takes into account both the closing price and trading volume. This indicator is used for assess whether money is flowing into or out of an asset. An increase in the accumulation/distribution line indicates an accumulation of capital, while a decrease indicates a distribution.

Momentum indicators for Immediate Edge

Relative Strength Index (RSI)

The RSI, mentioned earlier as a trend indicator, can also be used as a momentum indicator. When the RSI shows a divergence from price movements, may indicate a potential turning point. For example, if the RSI is making new highs while prices are not, it could indicate a bearish divergence.

Moving Average Convergence Divergence (MACD)

The MACD, previously mentioned as a trend indicator, can also be used as a momentum indicator. When the MACD line and the signal line intersect, it can indicate a potential turning point. If the MACD line crosses above the signal line, it can be considered a bullish signal, while if it crosses below, it can be considered a bearish signal.

Conclusion

Technical indicators can be Powerful tools for financial traders who want to get an Immediate Edge. Each indicator has its own purpose and provides specific information about price movement and the strength of a trend. It is important to understand how to use these indicators correctly and combine different strategies to make informed trading decisions.

Incorporate technical indicators into your analysis it can increase your ability to identify promising trading opportunities and reduce your risk of unprofitable investments. Always remember to test your trading strategies and adapt them to ever changing market conditions.

Leave a Reply

View Comments