Grandparents no longer need to open their coin purse to tip their grandchildren. Flowe launches Flowe Junior, the prepaid card for kids from 7 to 14 years that with its really smart app allows you to manage the financial education of the very young. A way to leave the right space for independence for children, without giving up the supervision of adults.

The Flowe Junior prepaid card, designed for kids’ financial education

At the presentation event of the new prepaid card, Flowe wanted to start with data. In fact, he asked Cosimo Finzi, CEO of Astra Research, to return a photograph of the children’s relationship with technology and money management. Asking both the parents of boys between 7 and 18 and directly to adolescents between 14 and 18.

What emerges has two main guidelines. On the one hand, guys use technology a lot: 86% use a smartphone (99% between 16 and 18 years). And if communication and social media are among the most used tools, even the 38.5% use technology for purchases. Of these, a third buys online without adult supervision. By asking children between 14 and 18 directly, 43.9% shop online “often”, while 43.4% “rarely”. But the vast majority do them.

On the other hand, only 34.3% have a very good assessment of their financial competence. The 92% of parents think it is important to educate their children about money, but many don’t know how to do it. The strategies are different, although most parents use a mix of savings tips, cheap rewards. 25% give pocket money, 41% from a mix of gratuities and on-demand purchases. But a great difficulty lies in talking to children about money.

The means of the prepaid card is known by 68.7% of parents, 35% of children between 14 and 18 have one. And according to the data, 52.3% of parents do not control the use that children make of it. They say they use it especially for children online purchases (73.8%) but there is a great propensity to savings for future purchases (47.7%).

Financial education

An old adage said that “at the table we never talk about politics, sex and money”. Yet there is a need to educate their children in citizenship, affectivity and financial management. The psychotherapist Stefania Andreoli explains that one of the tasks of parents is to eradicate these taboos by teaching the value of money appropriately.

Which up to 9-10 can consist of a shared game, in which the cost of things is taught by focusing on simulation. But that already from the medium can become an opportunity to grant freedoms monitored by parents. For example with pocket money. But that must be contracted: deciding with the children the size, the deadline (better weekly for the little ones, monthly from high school) and the purchases that go beyond. In this way the children have controlled autonomy, without going through the possible “humiliation” of asking for every little thing. They can also learn how to save for a goal, to deal with limits and possible “penalties”. The psychotherapist also recommends disengage from the subject of reward for good grades or for helping around the house: the right to study and the need to collaborate is better not to monetize them.

But if the theory fascinates, the practice can get complicated. For this reason it was born Flowe Junior, a prepaid card that makes it easier for you to manage your children’s financial education. Really simple e smart.

How Flowe Junior works

Flowe’s CEO Ivan Mazzoleni and the president Oscar de Montigny then explained Flowe’s intent with these financial products. The company has decided to present itself as a Benefit company to be reported not only on earnings, but also on the values it proposes. And that offinancial education, which can give the generations of tomorrow the material tools to build a fairer and more sustainable world (already today), is perfectly embodied in the tools of Flowe Junior.

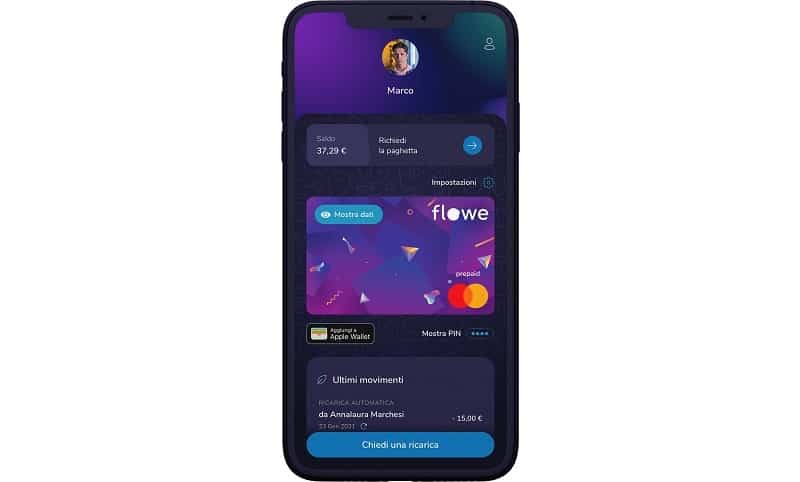

The children’s prepaid app communicates directly con that of the parents. Who can thus exercise an important and due control over the purchases of their children. For example it becomes possible exclude some product categories (by default you cannot buy alcohol and tobacco), so that the children respect the limits set at home. Parents also receive notifications directly from their app, so they know about their children’s movements.

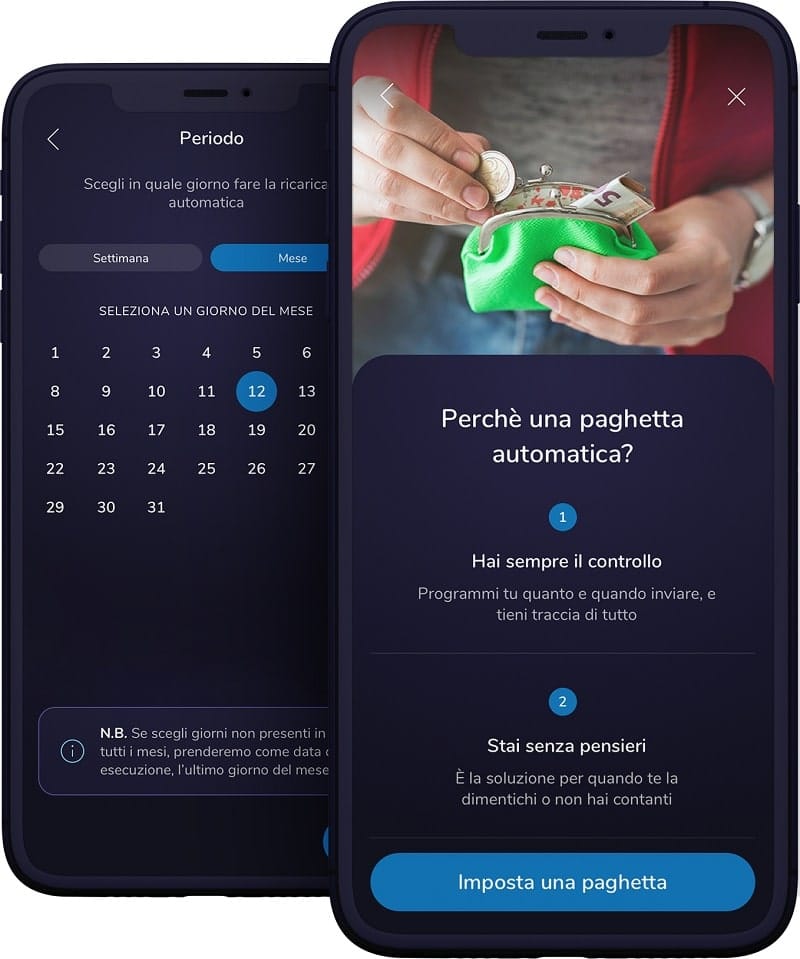

You can also set one pocket money with a fixed term, in order to be precise on the “contract” you stipulate with the boys. But on the other hand, you can also make transfers and top-ups in real time: for example for a tip for grandparents’ birthdays.

In addition, the artificial intelligence algorithm offers a chatbot called WAI, which answers all the financial questions your children (or even you) may have. If any questions are too complex for AI, a Flowe expert will answer them instead.

As you can see, Flowe does more than just a prepaid card. It’s a tool di forfinancial development that can provide children with a protected environment to learn how to manage their financial resources. You can find out more and open a card at this address.

Leave a Reply

View Comments