Investing your own money is often an operation of trust: savers often focus on well-known names to be on the safe side. But in a world of centuries-old banks and new emerging fintechs, there comes a new contender for our savings: Apple Savingsthe account launched by the “mother” of the iPhone.

Apple Savings, Cupertino also aims at the world of banks

One way to make your liquidity in a context of apparently low inflation and rate hikes imposed by Central Banks is to opt for i deposit accounts. A safe and (relatively) advantageous solution. This trend is emerging among the saverswho see deposit accounts as the new protagonists of their investment choices.

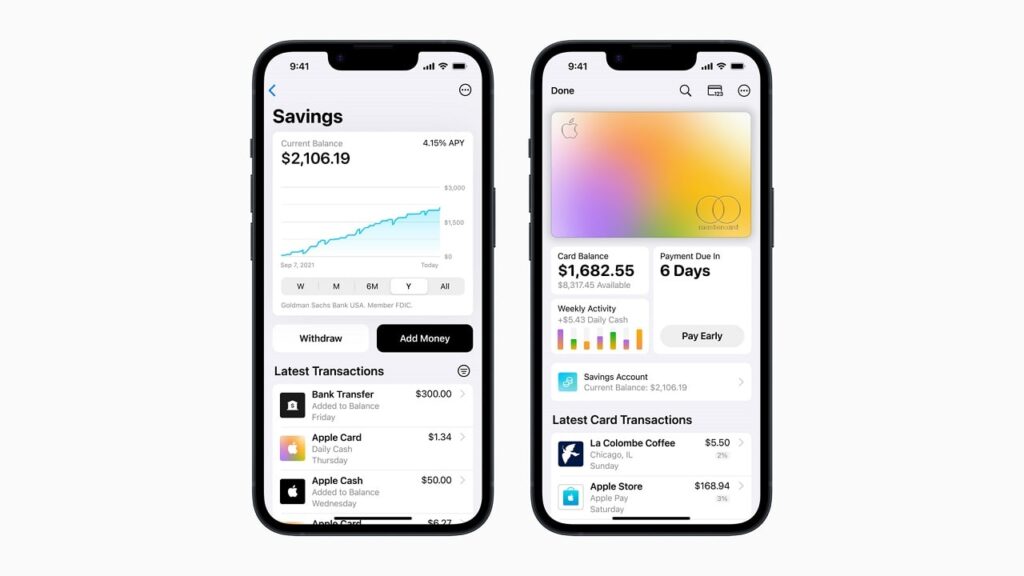

Apple has seized this opportunity and decided to enter competition with traditional banks, launching, in partnership with Goldman Sachsand deposit account called Apple Savings.

It’s a tool at the moment only available in the United States and for customers residing in that country. Something that yes very close to a checking accountbut which is designed above all for saving money and not for its day-to-day operations. Indeed, it is a deposit account high-yield offering an annual yield of 4.15%.

Combined with Apple services

The account is matched to the Apple Card, the credit card of Cupertino’s big tech, and has no minimum deposit. Furthermore, it is protected by the Federal Deposit Insurance Corporation (FDIC), the same body that saved SVB’s deposits.

The maximum account balance goes up to $250,000. The money can’t be used directly from the Apple account – it’s a savings account. But it has to be first transferred to a real checking account or Apple Cash.

The rate of 4.15% is higher than that of a standard savings account and its main competitors. To compare all stars and stripes, Ally Bank e Marcus – owned by Goldman – offer rates of 3.75% and 3.9% respectively. Furthermore, you can choose to have the Daily Cash rewards, i.e. the cashback up to 3% that Apple Card insures from the launch of the credit card.

Apple can conquer another market

Experts believe that the advantageous rate and the fame of the Apple brand can be a winning combination for attracting new bank customers. Especially now that the bankruptcy of SVB e Signature Bank it undermined trust in traditional banks.

In fact, according to the Financial Times, American financial groups Charles Schwab, State Street and M&T lost $60 billion in deposits in the first quarter. With clients first moving in search of higher yields and then, following the collapse of SVB and Signature Bank, triggering a liquidity flight from deposits out of fear. That the Apple with one bite can win the trust of savers who have lost it?

Source

Wall Street Italia

Leave a Reply

View Comments