Apple announced his service Pay Laterwhich allows you to finance the purchase of an iPhone, a Mac or another Apple product and then pay for it in installments. A service BNPL (Buy Now Pay Later), which has no cost to users if they pay on time. Cupertino will finance the project on its own, without support from external financial institutions as has been done in the past. In fact, it looks like it’s about to arrive Apple Financing LLCturning the Apple into a bank, or almost.

Apple becomes a bank with the Pay Later service

The announcement came on Monday in the WWDC 2022 keynote, when Apple unveiled Pay Later to developers and the press around the world. It is a mechanism already used by other companies, indeed more and more widespread.

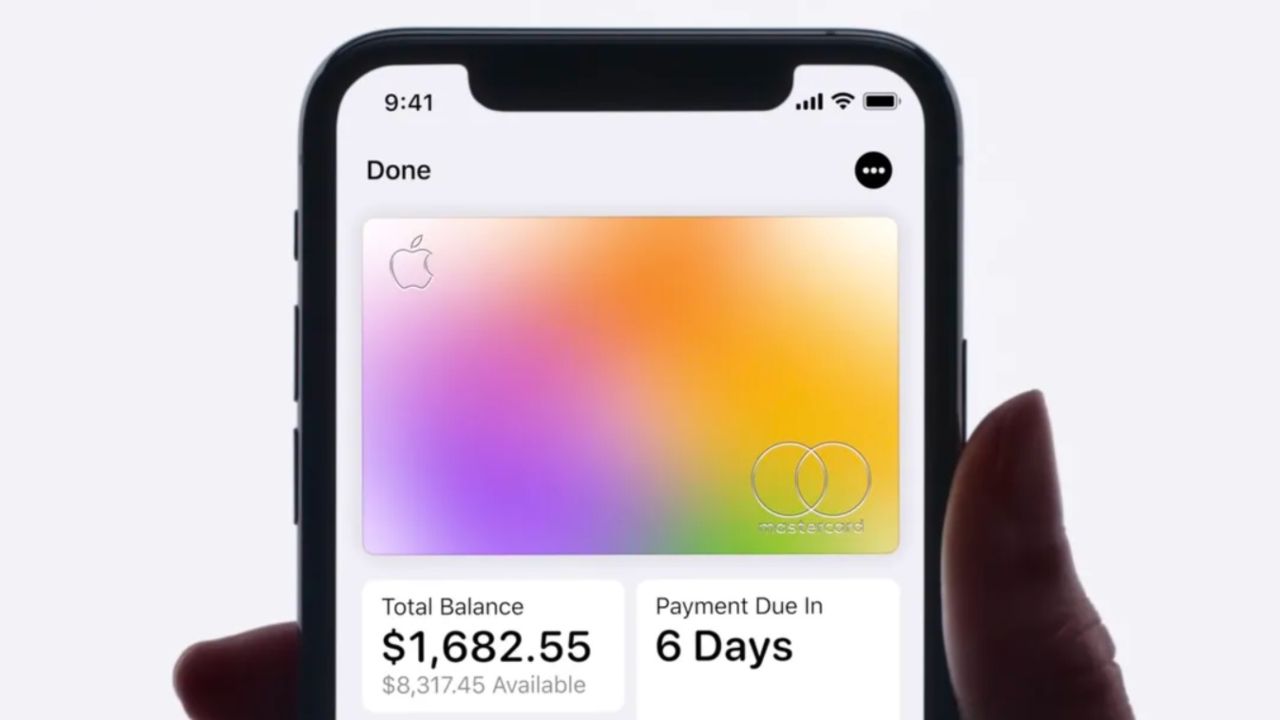

The recipe for Apple is to defer payments for iPhones, Macs and other devices in four equal installments over the next six weekswithout no interest. So you don’t need to have all the funds right away to buy the new iPhone 14 when it comes out in September, but you can pay a quarter every ten days or so.

According to reports from Bloomberg and CNBC, Apple will not rely on one of the companies that guarantee this service. Instead will create Apple Financing LLC, to manage loans to users internally. And he’s already looking for employees for Pay Later.

La Mela wants to be a bank

It is not the first time that Apple has introduced a service that is usually the prerogative of financial and banking institutions. But it is the first time that it has assumed all the burdens of an operation of this type. The services of the Apple Cardthe credit card of the Apple, are guaranteed in the United States by Goldman Sachs.

This time, Apple Pay Later has the coverage guaranteed by Apple. But Goldman Sachs still plays an important role: the users they will have to use an Apple Card (Mastercard circuit) to use Pay Later. This is because Apple Financing technically and legally will not be a bank, although it will act as a lender for customer purchases.

This also translates into the fact that Apple will conduct checks on the banking situation of who its Pay Later. But apparently, the non-payment of installments for Apple products will not enter the banking history of customers, with Apple remaining outside the American credit circuit.

It is not clear if they will pay penalties in case of delay. M.a it seems that the maximum payable in financing is around a thousand dollars. So at least part of the new iPhone Pros you will have to pay for it directly.

Apple Pay Later, a possibility but also a risk

The decision to directly finance its customers’ purchases for Apple is an important opportunity. Not only does it incentivize the use of the Apple Card, but it also encourages customers to spend more. SFGate explains that Americans average they spend $ 365 to purchase with BNL serviceswhile the average for credit card purchases is $ 100.

Furthermore, as for the possibility of buying iPhone in monthly subscription considered in the past months, this type of service allows ‘bind’ users to continue to remain in the Apple ecosystem.

But there are risks, for both Apple and customers. In fact, several studies show that the incentive to spend more with BNPL brings a phigher percentage of people to spend beyond their abilities. Ending up in debt. For this reason, several BNPL companies have come under the magnifying glass of different governments.

Apple will launch Pay Later in the United States first, likely also to test the waters ahead of a launch in Europe, where the banking regulations are very rigidthe. If Pay Later will also arrive in Italy, Apple will have to answer to consumer protection agencies and banking ones.

In short, the possibility they are huge but also i potential risks for Apple are not to be underestimatedAnd. In all likelihood, Apple will test this new feature in the US for a long time before it arrives in Europe. We will keep you updated in case of changes in the situation.

Leave a Reply

View Comments