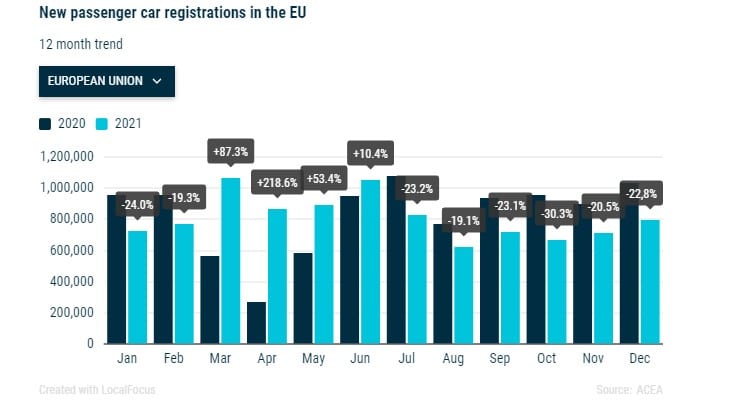

New car registrations in Europe they decreased by 2.4% in 2021, even further below the previous record low recorded in the market in 2020, according to industry data shown by the European Association of Automobile Manufacturers (ACEA) on Tuesday. The figure improves slightly if we also consider the European regions outside the EU, i.e. the United Kingdom and the EFTA (European Free Trade Association) where 11,774,885 cars were registered against 11,958,116 in 2020 (-1.5%).

A global shortage of semiconductors and other supply chain problems have dampened automotive deliveries globally, with many automakers sitting on semi-finished products and unable to meet demand.

Germany was the most affected among the main EU markets, as shown by Acea’s data, registering a 10.1% decline in sales over the year, while others such as Italy, Spain and France recorded marginal growth.

The number of new vehicles registered in the European Union, Great Britain and the European Free Trade Association (EFTA) in December fell 21.7% year on year, marking the sixth consecutive month of decline.

This follows the historic decline by almost 24% upbito in 2020 due to restrictions owed to the pandemic which brought new car registrations in the EU to 3.3 million less than pre-crisis sales in 2019.

“This decline was the result of the shortage of semiconductors which had a negative impact on car production throughout the year, but especially during the second half of 2021”, ACEA said.

Automakers initially downplayed the impact of the chip shortage, but ultimately led to slow production and even shut down some factories. Car sales in the EU recorded a strong increase in the second quarter, but if you look at the full semester they fell by around 20%.

And certainly the short-term outlook for supplies is not good. “The start of 2022 will still be challenging in terms of chip supplies,” Alexandre Marian of consulting firm AlixPartners told AFP. The situation should improve in the middle of the year, but that does not mean that other problems will not arise, regarding raw materials, supply chains and labor shortages “, he has declared.

Italy recorded the highest increase (+ 5.5%), followed by Spain (+ 1.0%) and France (+ 0.5%) But the 10.1% decline in Germany dragged the overall EU figure down. While the shortage of semiconductors was the main factor holding back growth, it should also be noted that the EU underperformed the other major markets where the recovery from the pandemic was stronger. In fact, the Chinese car market grew by 4.4% and the US by 3.7%.

The decline in European sales could also be due to “the sharp rise in the average price of cars, as well as an attitude of expectation on the part of consumers towards electric vehicles that is driving them to postpone purchases and keep their current vehicle longer. “, said analysts from Inovev, an automotive data analytics company.

Car market 2021 in Europe, all the top three of the ranking are down

The top three European carmakers have all seen a drop in sales in Europe. Volkswagen managed to keep the top spot, but saw sales drop by 4.8% equal to 1.4 million vehicles which cost it a downsizing of its market share to 25.1%. Stellantis suffered a minor decline, or 2.1% with 2.1 million units sold, bringing its market share to 21.9%.

The Renault group (Renault, Dacia, Alpine and Lada) have to lick their wounds with a -10%, and with sales of its core brand down 16%. On the other hand, the sales of its Dacia brand and the Alpine sports brand have increased. The French auto group saw its market share shrink to 10.6%. BMW recorded a 1.5% increase in registrations, but Daimler, owner of the Mercedes and Smart brands, suffered a decline of 12.4%.

The Korean group Hyundai, which also includes Kia, consolidated its position as the fourth largest car manufacturer in the EU with an increase of 18.4% to over 828,000 vehicles. Its market share has risen to 8.5%.

The data, provided by ACEA members, does not include sales of US electric vehicle manufacturer Tesla, nor does it include the breakdown for gasoline, diesel and electric vehicles, which are provided in a separate quarterly report.

Leave a Reply

View Comments