A couple of months ago I was in the United States for the CES in Las Vegas and, during a little tour of the trusted outlet, I came across a sign indicating the possibility of paying with Klarna. Directly in the shop.

I don’t know how widespread this payment method is within the stores, I don’t frequent it enough, but it affected me a lot.

Or rather, Klarna intrigued me a lot because, in the space of a few months, I went from “I’ve never heard of it” to having their logo often and willingly under my eyes. And so I decided to have a chat with Daniel Long, Vice President of Product and Consumer App Domain of Klarna.

What is Klarna?

![]() Daniel Lange, Vice President Product and Consumer App Domain at Klarna

Daniel Lange, Vice President Product and Consumer App Domain at Klarna

If I had to explain it to you I would probably tell you that Klarna is a service that allows you to pay for your latest purchase in three networks.

Well, that would be a bit of an understatement.

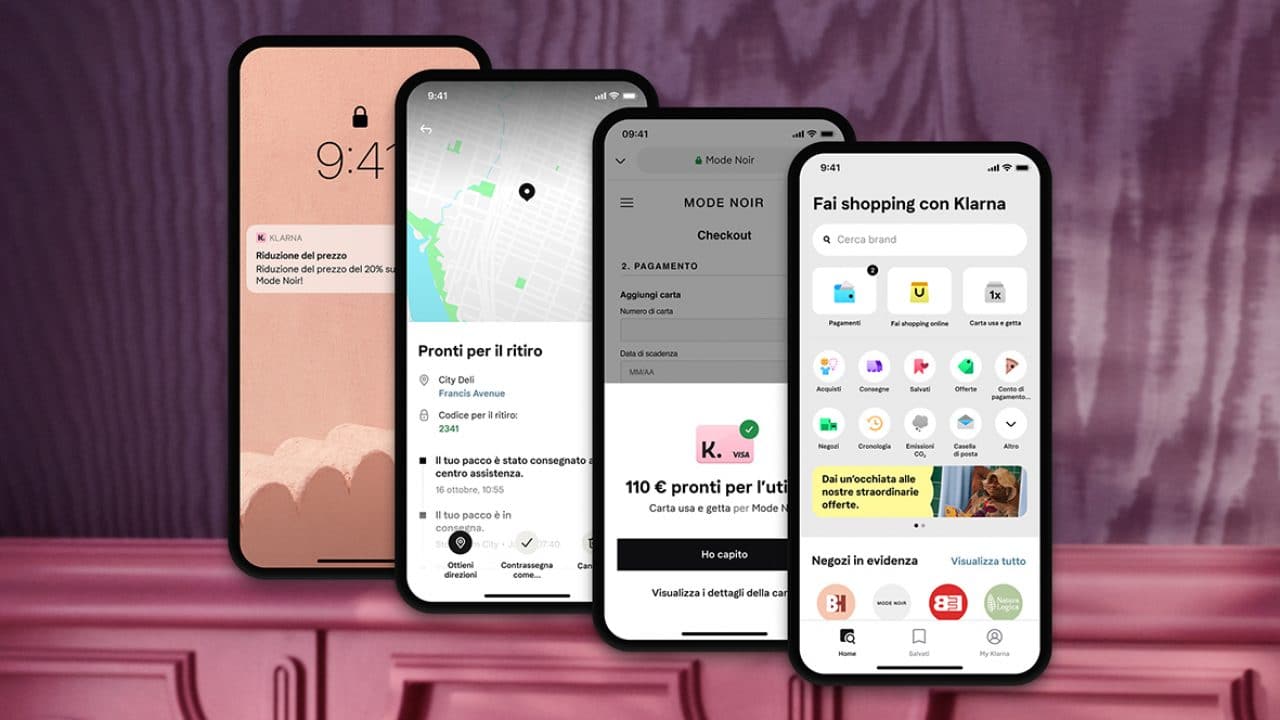

“We created a one of a kind shopping application – Daniel Lange explains to me – which allows you to help users fin from the beginning, from understanding what they want to buy, to the actual purchase, using payment methods that include our application, vendor integrations or a virtual card. […] And then we help you track the order, which is probably the most annoying part, the one where you wait for the goods to arrive at your home. So we have decided to be extremely transparent, telling you when you will approximately receive your purchase and keeping you updated on the status of the shipment. When you receive the goods you have to make a decision: keep the product or return it. Also in this phase we want to help our users so, if you want to return the object, we generate a dedicated label or we provide you with the information necessary for the return. And then, at the end of it all, there is the payment. “

You understand well that we are a little over my “pay in three installments”. In fact, that is the last step of a much longer and more detailed process, where the watchword is “transparency”. After all, the name of the company says it all: Klarna, in Swedish, really means “clear”, “transparent”.

The new application of Klarna

The new Klarna application has been available for a few days, bringing two new features to Italy: Pay Now and the Bonus Club.

The first feature is, to all intents and purposes, a new payment method, which allows you to pay the full amount immediately wherever Klarna is available. Yet the claim of the service says “Buy now, pay later”, or “Buy now, pay later”. So I ask Daniel if this is not a bit in contrast with what has been done up to now: “We want to create the best possible shopping experience for users. And we know that there are several payment methods that can be useful in equally different situations. TOWe have therefore given consumers the opportunity to decide which payment option to use, helping them regardless of the choice they decide to make. “

All of this allows you to use Klarna to pay for anything. Think, for example, of renting a scooter, an Uber or any other service that involves small amounts, which do not need to be divided into three different installments. The purpose of the Swedish company is therefore to become the reference payment method, which can be used anywhere, at any time and for any expense.

Pay Now, however, is not the only novelty. As anticipated, the Klarna app is also enriched by the Bonus Club: “For every purchase you earn points, which can be converted into actual benefits, such as a gift card, which you can use for future purchases, or a series of exclusive activities that change continuously. However, purchasing is not the only way to earn points. There are actions that allow you to do this, for example browsing the wishlists. Just create one and add a product. “

The Bonus Club has only just landed in Italy but has actually existed since 2020, with over 4 million registered members in the United States and Italy, a sign that the system works and is appreciated by users.

And what are the advantages for companies?

At this point it is clear to me why a user should try Klarna. The Swedish app allows you to shop almost anywhere: the partner list includes Samsung, Amazon, Zalando, eBay, Unieuro, Nike, Sephora, MediaWorld, Apple, Dyson, Adidas, Ikea and much more. The list seems almost endless. All this by deciding whether to pay the bill immediately or divide it into three installments. A nice convenience.

But I ask Daniel Lange how it works for companies. In short, what are the advantages? The Vice President Product and Consumer App Domain explains to me that for today’s consumers the shopping experience is central and Klarna has been designed to enhance that experience, then prompting consumers to come back and make new purchases in that specific store or website. Not to mention that 75% of Italian consumers tend to evaluate in a more positive way those shops where there is an option that uses the “buy now, pay later” formula. integration with Klarna only increases the chance that a user will finalize the purchase.

The integration is also very simple, not particularly different from what is offered by other payment methods, including credit cards. The difference is that Klarna keeps communication open. Not everything ends with the final transaction but, as Daniel anticipated before, he informs customers about the status of the shipment, the possible date of arrival, any return policies … In short, there is a great deal of attention to final consumers but also the will to protect sellers. Here because Klarna bears the risk of a failure to pay: “The shopkeeper gets paid regardless. If for any reason the user cannot pay an installment, Klarna assumes the responsibility. “

And what happens on the user side instead? “If you can’t pay an installment, we limit the service, so you won’t be able to use Klarna until you pay off the debt. Obviously we will send you reminders and eventually we will start working together to understand how to solve the problem. “

Privacy is central

“Privacy and data security are at the heart of our business. – Daniel Lange tells me – When it is necessary to share information, we do it only with the explicit consent of the user. We also provide help to customers, within the app, when it comes to filling out forms or entering credentials at checkout, but only if requested by the users themselves. So the data is shared only if the consumer wants. “

Not to mention that, being a European company, Klarna is obliged to comply with EU legislation – the GDPR -, keeping the data of customers and sellers safe.

What does the future have to offer?

Before saying goodbye to Daniel, I can’t help but ask him what to expect in the near future: “We want to offer users the best possible shopping experience. This is our ultimate goal. So we will continue to improve the app, introducing new features and improving the general user experience of the users. The new homepage is already a major change, a foundation for future growth and expansion. […] We will start with a section in which to insert loyalty cards and a series of tools related to personal finances; we would like to create a platform for live shopping events and add more details related to the product, such as a price comparator and availability in the stores. “

In short, there will be many news to come and all designed to put the user at the center.

Leave a Reply

View Comments