TrendForce says MLCC prices are continuously falling. They will decline further by 3-6% in 2022 as demand continues to weaken

With the evolving course of the COVID-19 pandemic, China abides by its “dynamic zero-COVID policy” and has been slow to lift the blockade of its cities. Especially from those recently affected by the outbreaks of the disease. Therefore, the manufacturing industries of major Chinese cities they are facing delays in the resumption of normal activity and in 2022 a production gap has emerged. For the Electronic ODMsit will be difficult to close this production gap in 2022.

Furthermore, ongoing global inflation keeps commodity prices at a very high level. The effect of inflationary pressure was particularly evident in the demand for consumer electronics such as smartphone, notebook e tablet. This, in turn, also has an impact on MLCC market in terms of demand and stocks. Currently, the general inventory level has increased by more than 90 days for MLCCs of all sizes. Therefore, TrendForce (here for site) predicts consumer MLCC prices to drop further by 3-6% on average in 2022.

Details on the prices of MLCCs in continuous decline

On the other hand, the demand remains quite strong in some application segments. Such as, for example, high performance computing solutions (which include servers), network equipment, industrial automation solutions and energy storage systems. Furthermore, the IDM in the semiconductor industry they will adjust the allocation of production capacity as the consumer electronics market continues to slow down in 2022. As a result, the under-supply situation for some ICs will ease.

In addition, demand will be sustained in the high-end segment of the MLCC market and other application segments (e.g. automotive electronics and industrial equipment). All in all, thanks to the demand for automotive electronics, servers, network equipment, etc., TrendForce expects MLCC’s total annual shipments will increase by 2% on an annual basis at approx 2.58 trillion pieces for 2022.

Decrease not only in prices

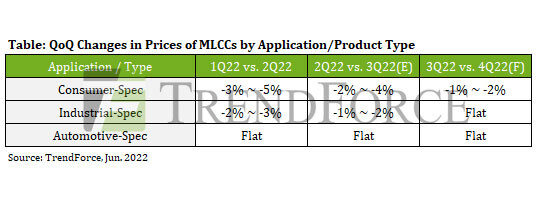

Shipping and prices fell for consumer-specification MLCCs, while prices for automotive and industrial-specification MLCCs remained stable. According to TrendForce research, Consumer MLCC prices fell by 5-10% on average in the period from 2021 to 1Q22. To further stimulate demand, MLCC suppliers lowered their prices further 3-5% in 2Q22.

In fact, the price has dropped to the level of material cost for some low-end consumer-spec MLCCs. In previous market cycles for MLCCs, the inflection point in supply-demand dynamics tended to occur as a result of continuous increases or decreases in both prices and shipments. For example, prices and shipments followed an upward trajectory from 2020 to 2021. And from now on, prices and shipments have been falling for two consecutive quarters. Looking ahead, there will be no easing of downward pressure, so quotations for consumer MLCCs are expected to drop of 3-6% during the 2H22.

MLCC with industrial specifications

For industry-specific MLCCs for niche applications, the overall demand for these products will increase. This will happen because buyers will experience an easing of supply for some semiconductor chips. TrendForce currently expects prices of industry-specific MLCCs to fall more moderately than1-2% during 2H22 or will remain mostly stable for the period. As for automotive MLCCs, pricing and shipments will remain stable as quote offers and contract negotiations are conducted on an annual basis for this product category.

MLCC suppliers in Japan, South Korea and Taiwan are expanding their offerings to limit the impacts of fluctuating demand in the consumer electronics market. Japanese MLCC suppliers Murata and TDK now almost control the80% of the automotive MLCC market share. In addition to increasing production capacity for automotive offerings, these two suppliers are also strengthening the service offering for various related applications. In the fields of automotive propulsion systems and ADAS, Murata and TDK have started providing solutions and services for image sensor modules, intelligent parking assistance modules (IPA), ecc.

Production increase from Samsung eYAGEO

The Samsung of South Korea has successfully completed the qualification process for its automotive offerings this year. Moving on to the 3Q22, Samsung production capacity will gradually increase for automotive offerings at its Tianjin plant. With regard to YAGEO (here for more info) Taiwan, new production lines at its Kaohsiung base are expected to begin pilot production in 4Q22. Much of the additional production capacity that YAGEO will take on is 22u high-voltage and large automotive MLCCs (e.g. 0805 and 1210 products). The new production lines will bring it into mass production towards the end of 1Q23. With the initial total production capacity reaching 8-10 billion pieces per month. YAGEO is also diversifying its services and solutions to expand into high-end application segments such as military technologiesnetwork equipment, automotive electronics, medical devicesecc.

Recovery after COVID-19

TrendForce’s latest investigation of COVID-19 blockades in China finds that the manufacturing industries residing in the eastern part of the country are starting to recover. Looking specifically to Shanghai, the transport of goods out of its seaports and airports is gradually returning to normal. Therefore, the production sites of the ODMs located within the region will be able to increase shipments again of finished products.

Additionally, the component mismatch problem will lessen significantly as the logistics system, as a whole, is returning to normal operation. Improved logistics will therefore give impetus to growth in finished product shipments in 3Q22. On the other hand, several important variables will affect the MLCC market. These include the geopolitical tensionsthe maintenance of zero-COVID policy by the Chinese government and the possibility of inflation turning into stagflation.

And what do you think of this price factor MLCC in continuous descent? tell us yours below in the comments and stay connected on TechGameWorld.com, for the latest news from the world of technology (and more!).

The article MLCC prices continuously falling: news from TrendForce comes from TechGameWorld.com.

Leave a Reply

View Comments