Demand for LCD monitors continues to weaken in 2H22, annual shipments at just 139.9 million units, says TrendForce

TrendForce (here to visit) is a global leader in providing in-depth market information and professional advisory services to clients across a wide range of industries. Additionally, TrendForce has established itself as a solid platform for exchanging vital market information between companies from different industries. With a worldwide member base of over 500,000 subscribers, TrendForce has built strong relationships with clients engaged in the most important and newly emerging technology sectors. TrendForce hosts at least five annual conferences in Aisa (for example, in Shenzhen and Taipei). These events showcase the latest research on industry and market trends. In addition, they offer professionals a place to network and explore various business opportunities.

Details on weakening demand for LCD monitors in 2H22

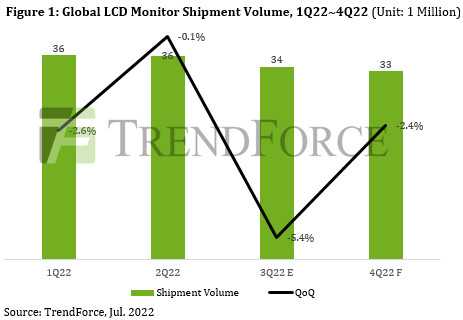

According to TrendForce research, the global shipments of LCD monitors reached 72.3 million units in 1H22, a level on par with the same period in 2021. Some orders for whole devices in 4Q21 were postponed to 1Q22 due to logistics and transportation issues. Additionally, some brands felt optimistic about the outlook for 2022, so they launched aggressive promotions to stimulate sales in 1Q22. The Russian-Ukrainian war and rising inflation have severely impacted demand in the European consumer market since the second quarter. But the demand for business models is still positive, which in turn bridges the gap left by the consumer market.

Looking forward to the LCD market trends in 2H22, TrendForce indicates that as most orders for business models had been digested by the end of 2Q22, coupled with the slow pace of new orders, the overall momentum of corporate demand was not as good as in 1H22. Consumption patterns are affected by rising inflation e of interest rate hikes in the United States and market consumption continues to remain dormant. Shipments of LCD monitors are expected they will decrease by 5.4% and 2.4% on a quarterly basis in 3Q22 and 4Q22 respectively. The percentage of shipments in the first and second half of the year will drop to about 51.7: 48.3.

A solution

At present, container shortages and port congestion have decreased. In 2Q22, the transit time of entire LCD monitor devices from China to North America and Europe decreased by about 2-3 weeks compared to 1Q22. Also, as demand continues to weaken, inventory levels of all branded manufacturers’ devices have soared. The fastest way for brands to reduce available inventory is reduce the purchase of front-end panels, components and entire SI devices e introducing aggressive promotions to drive sales. TrendForce expects LCD monitor shipments to reach 139.9 million units in 2022, with a decrease of 3.5% on an annual basis. However, the shipping strategy used by brand manufacturers to control inventory could herald a peak-free high season and winter of discontent for panel makers and ISs in 2H22.

And you? what do you think of this not very exciting news coming from TrendForce on weakening demand for LCD monitors ? tell us yours below in the comments and stay connected on TechGameWorld.com, for the latest news from the world of technology (and not only!).

The TrendForce article states: The demand for LCD monitors continues to weaken comes from allotek.

Leave a Reply

View Comments