Anyone who wants to buy that iPhone 13 or that MacBook Air, but wants to defer payments for these products, will soon be able to take advantage of Apple’s new solution. Is called Apple Pay Later and allows you to pay arMake your purchases with Apple Paywithout interest or commissions: let’s see how it works.

Apple Pay Later: how Apple’s BNPL works

Apple Pay Later is the new Apple service that fits into the market of Buy Now Pay Later (BNPL). It deals with of one of the payment systems that allow you to to spread the cost of a product or service over several installments. Apple Pay Later was officially launched on Tuesday in the USit will be gradually available to all users over the next few months.

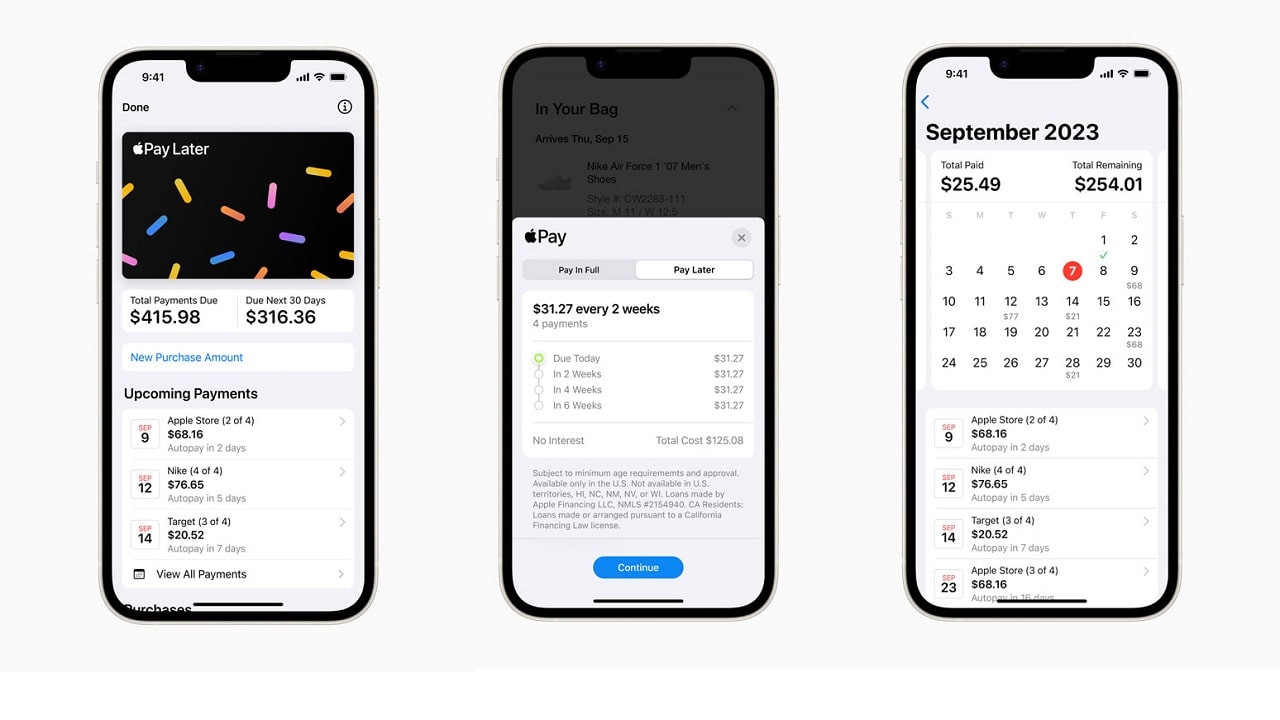

How Apple Pay Later works? It’s very simple, at least for users. All you need is an iPhone or iPad with Apple Wallet and a linked debit card. When you make a purchase with Apple Pay, online o in-app, you can choose the Apple Pay Later option. AND apply for a loan between 50 and 1000 dollars.

The loan comes approved in seconds, without impacting the user’s credit. And it allows you to pay in four installments every six weeks. The installments are interest-free and commission-free, unless you pay late.

Apple Pay Later is one way to make Apple’s products and services are more accessible and convenient, but also to retain users to its ecosystem. In fact, to use Apple Pay Later you need to have a Apple device and use Apple Wallet. Also, the service could incentivize users to spend more and more often with Apple Payincreasing Apple’s revenue from payment fees.

Apple Pay Later is a challenge for other companies offering BNPL services, such as Klarna, Affirm e Afterpay. These companies have seen a exponential growth in recent years. Apple will also offer the convenience of using Apple Pay as with other purchases. It also allows you to view and schedule payments on your iPhone.

Soon the service should also arrive in Italy, we will keep you updated.

Leave a Reply

View Comments