TheFork is the leading platform for online restaurant reservations. Announces another important step in the integration with at the Host fair the main Italian POS, in particular with the management software created by Zucchetti, among the most used in catering. In fact, Tilby has been joined by Zmenu, IlConto, Posby, Ristoquick and Posmaster3. POS are basic systems that manage digital restaurant transactions and payments and perform procedures such as calculating the bill and creating invoices. But today they have more and more functions beyond simple transaction management. Precisely from this perspective, their ability to communicate with leading restaurant management systems such as TheFork Manager makes them even more useful in increasing the productivity of the restaurant.

Simplification and speed at the basis of the dialogue between POS and TheFork Pay

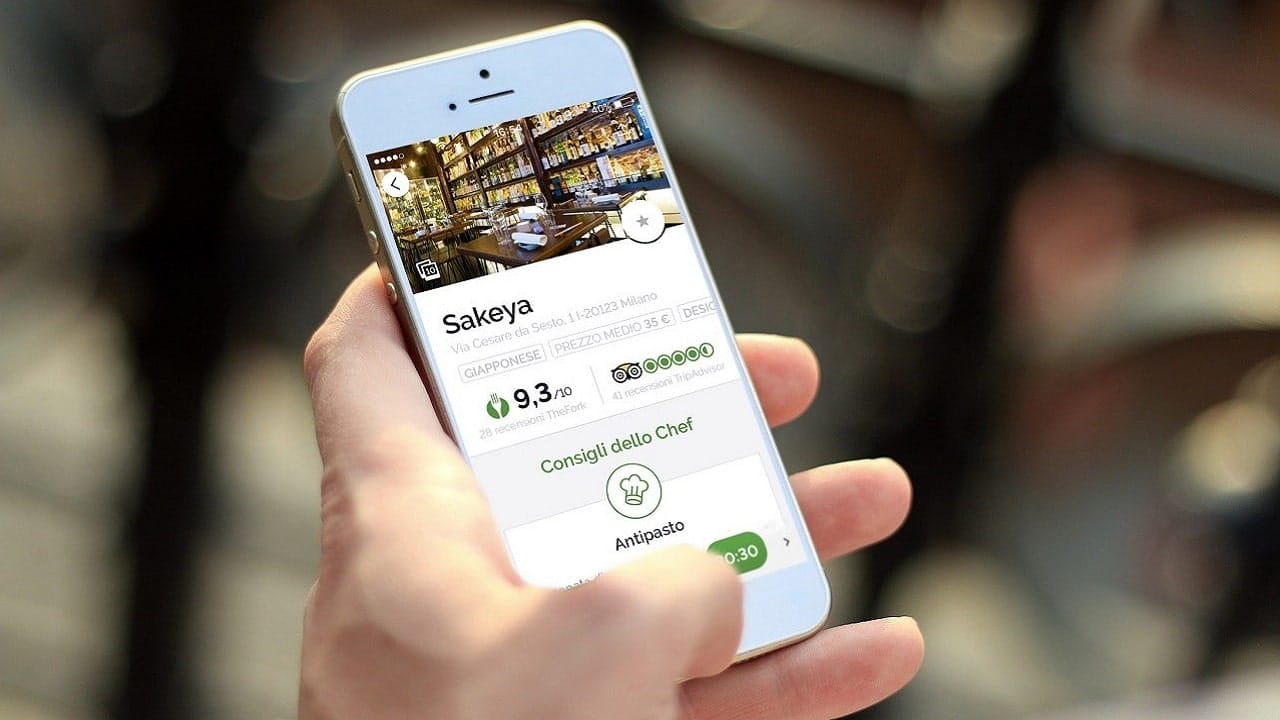

Integration, that will be effective at the end of 2023, aims to further simplify operations for managers. But also to speed up account processing for customers. This union will allow you to view everything that has been ordered and its price in real time simultaneously on the restaurant’s Zucchetti POS and on the customer’s TheFork app.

In this way, a digital pre-account will be available in real time. This allows you to pay with TheFork Pay without having to wait for the paper version of the account, saving time for customers and restaurants. This will be possible both with the reservation through TheFork and by paying at the table with the TheFork QR Code. Furthermore, the integration will allow the restaurant to automatically insert reservations received online via TheFork onto the POS.

Increasingly strategic digital payments

In fact, Italians increasingly like paying by card and smartphone. According to the Innovative Payments Observatory of the School of Management of the Polytechnic of Milan, digital payments have reached 8.5 billion transactions in 2022, a growth of +18% compared to the previous year. A fundamental component was represented by smartphone payments: last year they reached 15.5 billion euros, marking +119% compared to 2021, with an average transaction per capita of 6.4 million users. An essential asset in a challenging moment like the current one for the sector.

Leave a Reply

View Comments