In this article we will give you some tips in case you are wondering how to switch auto insurance partners

It can happen, even after having been insured for a long time with a company, to realize that changing can represent a good opportunity to save money or get some extra benefits. The budget toolin fact, it serves precisely this purpose: by comparing as many offers as possible, you can discover new opportunities, such as switching to a policy with a better price than the current one.

If it turns out that another insurance company offers a better price or conditions for our needs, switching is ideal and doing so today has become very easy. In fact, thanks to the abolition of the tacit renewal for motor policies with the approval of the Development Decree bis (dl number 179 of 18 October 2012), switching to another insurance company is simple, fast and does not require any cancellation.

Car insurance: how to activate the new policy

To take out a new car policy you must present:

- License plate of the vehicle to be insured, details of the holder and details of the policy holder;

- vehicle registration certificate;

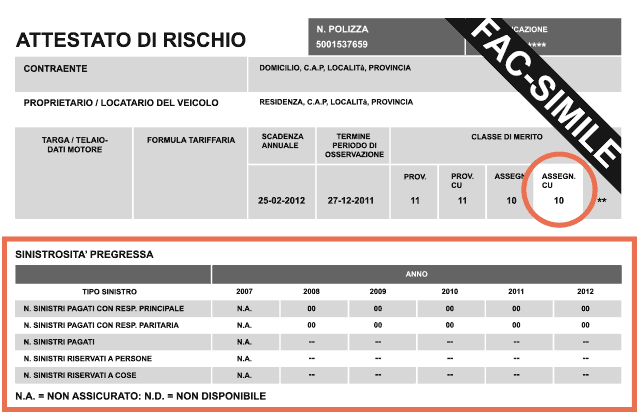

- Risk certificate.

The risk certificate is a document which shows the universal class of merit to which it belongs and the history of accidents in which the vehicle has been involved, and is useful for the company to determine the annual insurance premium to be requested from the policyholder . From 1st July 2015, the certificate of risk has become electronic and is no longer sent in paper form unless specifically requested by the policyholder. Allianz Direct makes it available, before the renewal of the policy and subsequently for a period of five years, in the customer’s Personal Area: it is easily accessible from the “Documents” section.

The digitization of this document obviously also facilitates the insurance companies who can find it easily online within the database managed by ANIA (National Association of Insurance Companies), in which all are required to file the certificates of individual policyholders. This translates into a streamlining of the procedures for issuing policies, which become faster, and a reduction in document forgeries.

Finally, the certificate of risk is also necessary if you want to benefit from concessions provided by the family liability insurancean extension of the previous Bersani Decree, to inherit the lowest class of merit within the family unit and save on the insurance premium.

Merit class

The merit class (CU), we recall, is a parameter universally recognized by all insurance companies which is based on the diligence and attention of motorists: the better you are, the fewer accidents you cause, the lower the class of merit and, consequently, the policy premium. There are 18 classes of merit for car insurance (the first is the best, the eighteenth the worst) and their mechanism is simple:

- When you cause two accidents, you are downgraded by two classes (malus);

- For each year that passes without causing an accident, one class goes up (bonus).

The class of merit that is assigned at the outset, if you do not have an insurance history and if you cannot take advantage of the best class in the same household, is the fourteenth. To verify the class of merit to which they belong, it is necessary to consult the risk certificate.

Conclusions

Basically, thanks to the recent updates of the laws, it has become much easier to change car insurance thanks to the digitization of the necessary documents and this facilitates the transition to a cheaper policy! From the engines section it’s everyone, keep following us!

Leave a Reply

View Comments