Since last February 1 in the industrial plan of Green Deal enter the proposal of European law on critical raw materials for electric motors.

The analysis of the impact of the European Law on critical raw materials on electric motors, source Depositphotos

The analysis of the impact of the European Law on critical raw materials on electric motors, source Depositphotos

Towards a zero emission economy

The proposal for a European regulation will have legal force for all 27 Member States once approved by the EU Parliament and Council.

This introduces absolutely new measures to accelerate the processes towards a zero-emission economy. Thus strengthening the resilience and competitiveness of the EU in the production of zero-emission technologies.

How the markets might react

This law could have big implications for different technologies and markets. But, one that is growing rapidly with a heavy dependence on critical raw materials is the electric vehicle (EV) market, especially the electric engines.

The analysis of IDTechEX

The latest research report by IDTechEx on electric motors predicts annual demand for rare earth magnets in EV motors to exceed 1 billion kg by 2031.

What will be the impact of this new act on the EV market?

Europe is dependent on other regions for the supply and processing of strategic raw materials.

One category highlighted in the law is that of rare earth elements for magnets. Including Nd, Pr, Tb, Dy, Gd, Sm and Ce.

Much of the law focuses on increasing mining (10% from the current 3%). Of the processing and refining (40%) and recycling (15%) of these materials by the EU.

The act recognizes that the EU cannot be self-sufficient in this sense, but it aims not to depend on any specific country for more than 65% of any single strategic raw material.

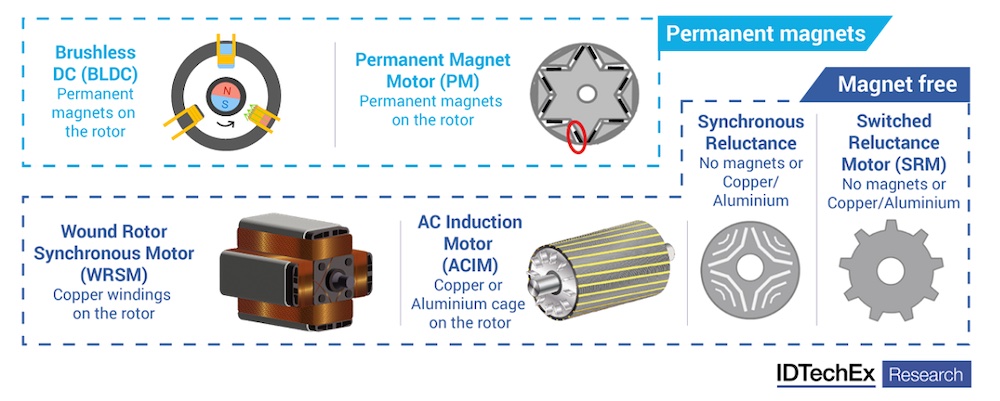

The analysis of the impact of the European Law on critical raw materials on electric motors, press office source

The analysis of the impact of the European Law on critical raw materials on electric motors, press office source

The electric motors of electric vehicles use rare earth magnets to a large extent

In 2022, 82% of the global electric car market will use rare earth-based permanent magnet (PM) motors. Exist alternative strategies, with OEM Europeans like Renault, BMW, Mercedes and Audi.

Tyres.it – Search for tires by size

These use magnet-free technologies, including wound rotor motors and induction motors. However, IDTechEx’s research reveals that their market share in 2022 was less than 23% in Europe.

The rules on recycling and on the content of magnets

The law assigns responsibility to the body that places the motor vehicle or light transport on the market. They must indicate whether they contain PM, the PM family (NdFeB, SmCo, AlNiCo, Ferrite.

And the location of the electric motors within the vehicle, with steps for removing them. This should help recyclers when it comes time to treat end-of-life engines.

In cases where the PM content exceeds 0.2kg (PM motors of electric cars are usually 1-3kg). The share of Nd, Dy, Pr, Tb, B, Sm, Ni and Co recovered from post-consumer waste must be disclosed. The specific recycled content quotas required have yet to be established.

Although the law establishes targets to reduce the EU’s dependence on imported materials. At the same time it does not establish how this can be achieved on the demand side.

For example, some OEMs may use a magnetless option which greatly reduces the demand for rare earths. But others may not, which was not factored into the act. The fact that an OEM that does not use PM does not have to declare or be concerned about the recycled content of its magnets is unlikely to be a key factor in reducing the OM content. A reduction in the PM content per engine or an increased adoption of smaller vehicles would also reduce demand, easing it, but this aspect was also not taken into account.

The LEVA-EU (Light Electric Vehicle Association) pointed out in its feedback to the EU Commission that the 0.2kg magnet weight will mean that some vehicle classes, such as electric cycles, will be excluded, while a hybrid cycle of series may not be. This makes it more difficult for some technologies or companies to operate. Furthermore, he points out that the supply of components for light electric vehicles (LEV) is already insufficient, and therefore companies (especially SMEs) have fewer choices when it comes to sourcing components. This act may discriminate against companies sourcing components from the EU versus non-EU regions.

According to IDTechEx, the EU Critical Raw Materials Act, in its current form, will have limited impact on the adoption of magnet-free motors in most EV categories, as the initial cost and volatility of material prices are a much more important determining factor. However, the law should start to pay more attention to the recycling of rare earths, which is currently only happening on a very small scale. In a market where motors are in higher demand, a higher recycled content or magnet-free design could become a point of differentiation for motor manufacturers selling in the EU. But in the opposite case, where components are in short supply, this makes it more difficult for the final vehicle manufacturer to comply with the proposed new law.

The latest edition of “Electric Motors for Electric Vehicles 2024-2034by IDTechEx takes a deep dive into engine technology, market adoption, material utilization, and market forecasting. The analysis is based on an extensive vehicle and engine database for all vehicle segments, including cars, buses, trucks, vans, two-wheelers, three-wheelers, microcars, and aircraft.

Leave a Reply

View Comments